Analysis of EUR/USD – 5M Timeframe

The EUR/USD currency pair exhibited virtually no trading activity on Monday—literally. There are days when the market is sideways, and then there are days when the market is completely inert. Yesterday was one of those days. No macroeconomic reports were published, no fundamental events occurred, and even the latest rhetorical jabs from Donald Trump directed at China failed to revive trading activity. Traders have become increasingly indifferent to statements from the U.S. President, having realized that Trump changes his stance as often as the wind. As a result, there was no reason for traders to enter the market.

Technically, the new uptrend remains intact and could resume at any moment. Several important macroeconomic reports are scheduled this week, so traders can reasonably expect a trending phase. The pair continues to trade above the Ichimoku indicator lines and previously broke through a descending trendline. Therefore, we continue to anticipate growth in the pair.

On the 5-minute timeframe, the price moved within a narrow range between the Kijun-sen line and the 1.1666 level throughout the day. Volatility did not exceed 40 pips. No valid trading signals were generated.

COT Report (Commitment of Traders)

The latest COT report is dated September 23. No newer reports have been published due to the ongoing U.S. government shutdown. As shown in the chart above, non-commercial traders' net positions had remained bullish for an extended period. Bears only briefly took control in late 2024 but lost their advantage quickly. Since Donald Trump began his second presidential term, the U.S. dollar has been in decline.

Although we can't say with 100% certainty that this decline will continue, current global developments suggest that scenario is quite plausible. We still see no fundamental factors supporting euro strength; however, there are plenty of reasons for continued weakness in the U.S. dollar. The long-term downtrend in the USD is still relevant, but in the current geopolitical context, historical trends spanning the last 17 years aren't as helpful. If and when Trump ends his trade wars, the dollar may strengthen again, but recent developments indicate these conflicts are far from over.

One of the most concerning factors for the USD remains the potential erosion of the Federal Reserve's independence, which adds additional downward pressure on the greenback.

The red and blue lines on the indicator still point to the continuation of a bullish trend. During the last reporting week, the number of long positions held by the "Non-commercial" group fell by 800 contracts, while short positions increased by 2,600. Therefore, the net position declined by 3,400. However, these figures are significantly outdated and currently hold little weight.

Analysis of EUR/USD – 1H Timeframe

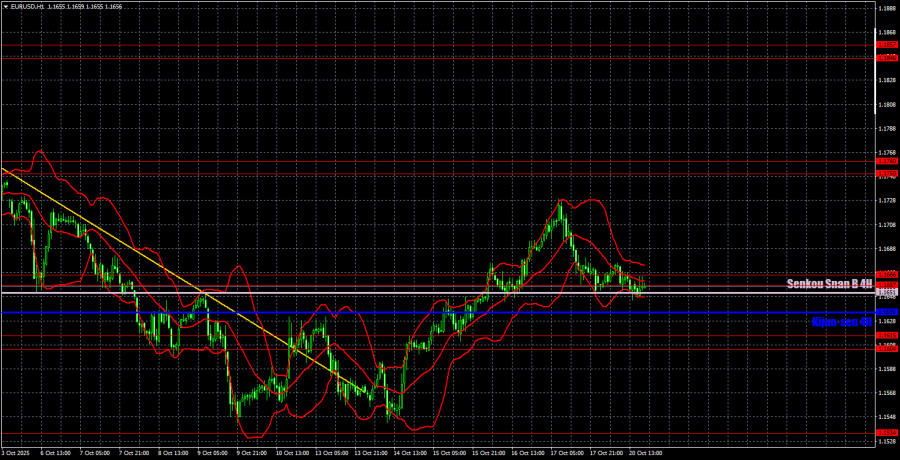

On the hourly chart, EUR/USD may have completed its downtrend as early as two weeks ago. The trendline, Kijun-sen, the 1.1604–1.1615 area, the 1.1657–1.1666 zone, and the Senkou Span B line have all been surpassed. Thus, we can now expect movement only to the upside. We believe that the euro has long been overdue for an upward move, especially now that all the necessary technical criteria have been met. Still, the market is slow to act on this, despite having enough justification.

Trading levels for Tuesday, October 21: 1.1234, 1.1274, 1.1362, 1.1426, 1.1534, 1.1604–1.1615, 1.1657–1.1666, 1.1750–1.1760, 1.1846–1.1857, 1.1922, 1.1971–1.1988, as well as the Senkou Span B level (1.1651) and the Kijun-sen line (1.1635). Note that Ichimoku lines can shift during the day and should be monitored in real time when identifying signals. Also, if the price moves at least 15 pips in the correct direction, make sure to set Stop Loss at breakeven to protect against potential false signals.

On Tuesday, the only notable event in the eurozone is another speech from European Central Bank President Christine Lagarde. This will be her 10th or so appearance in the past few weeks. As of yet, she has not communicated anything market-moving. The U.S. economic calendar remains empty.

Trading Recommendations:

On Tuesday, traders can continue to focus on the 1.1651–1.1666 zone. To open long positions targeting 1.1750–1.1760, wait for confirmation of a breakout above this area. We do not recommend shorting the pair, as the trend has clearly shifted upwards and there are numerous support levels below that may prevent further declines.

Explanation of Chart Elements:

- Resistance/Support Levels – thick red lines: These are zones where price movement may pause or reverse; they do not generate trading signals by themselves.

- Kijun-sen and Senkou Span B – key lines from the Ichimoku indicator, transferred to the hourly chart from the 4-hour timeframe; they serve as major points of support/resistance.

- Extremes – thin red lines: Previous swing highs or lows from which price historically bounced. They can generate trading signals.

- Yellow lines – include trendlines, channels, and other technical chart patterns.

- COT Indicator 1 (on charts): Shows the net position count by trader category.