Analysis of Trades and Trading Tips for the Euro

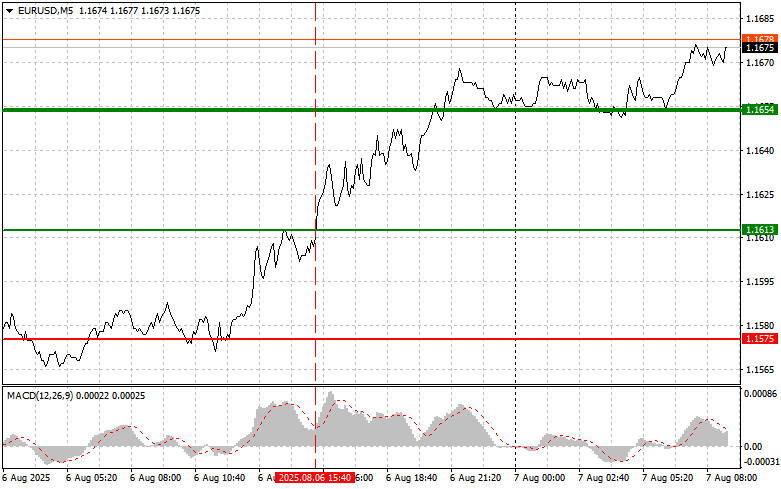

The test of the 1.1613 level occurred when the MACD indicator had already moved significantly above the zero mark, which limited the pair's upside potential. For this reason, I did not buy the euro and missed the entire upward movement.

Yesterday, three representatives of the U.S. Federal Reserve simultaneously voiced concern about the state of the U.S. labor market. The fact that such high-ranking officials issued statements in unison immediately sparked discussion in financial circles, prompting investors to reconsider their strategies and forecasts. The labor market, long a pillar of the U.S. economy, now appears to be showing cracks, prompting the Fed to seriously consider easing its monetary policy.

A rate cut, which not long ago seemed unlikely, is now becoming a tangible possibility. Such a step could stimulate economic activity, boost consumer spending, and ease debt burdens for companies and households. The U.S. dollar reacted immediately and predictably. The weakening of the currency suggests that market participants view the prospect of a rate cut as a sign of potential economic troubles. In the coming days, close attention will be paid to any new statements from Fed officials, as well as macroeconomic data that could shed light on the central bank's future actions.

Today's economic calendar is packed with important events, but the greatest focus is on data coming from Germany. In the first half of the day, updated figures on industrial production and the trade balance will be released. The state of industrial production is a key indicator of economic health. Growth in production volumes indicates increasing demand, new orders, and, consequently, a positive dynamic in GDP.

If the data is strong, the euro can be expected to strengthen, as this would signal stability in the German economy and, by extension, the eurozone as a whole. The trade balance is also of great significance. A positive balance—when exports exceed imports—indicates the competitiveness of German goods on the global market and capital inflows into the country. This factor also supports the euro. Conversely, weak industrial production figures or a negative trade balance could have a negative impact on the euro. Investors might interpret this as a sign of slowing German economic growth and begin selling the euro.

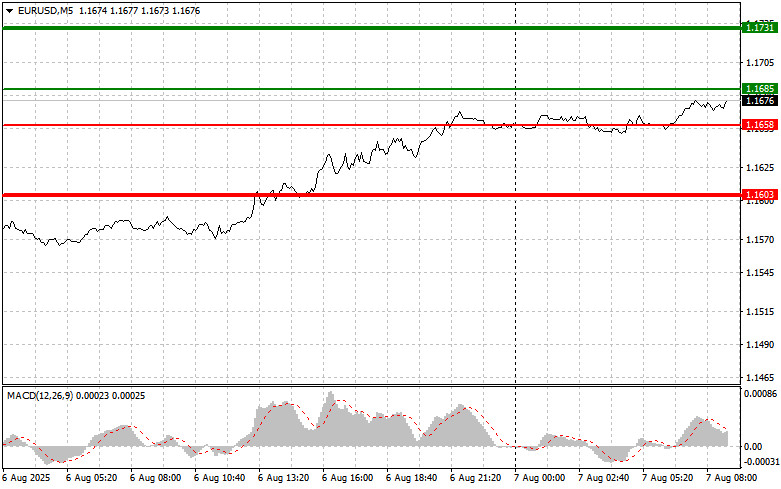

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

Scenario #1: I plan to buy the euro today when the price reaches the area around 1.1685 (green line on the chart) with a target of rising to the 1.1731 level. At 1.1731, I plan to exit the market and open a short position in the opposite direction, aiming for a 30–35 point retracement from the entry point. Buying the euro is advisable only if the data is strong.

Important: Before buying, make sure the MACD indicator is above the zero mark and just starting to rise.

Scenario #2: I also plan to buy the euro today in case of two consecutive tests of the 1.1658 level while the MACD indicator is in oversold territory. This would limit the pair's downside potential and lead to a market reversal to the upside. A rise toward the opposite levels of 1.1685 and 1.1731 can be expected.

Sell Scenario

Scenario #1: I plan to sell the euro after the price reaches the 1.1658 level (red line on the chart). The target will be 1.1603, where I plan to exit the market and open a long position in the opposite direction (aiming for a 20–25 point move in the opposite direction from the level). Selling pressure on the pair will return if the data are weak.

Important: Before selling, make sure the MACD indicator is below the zero mark and just beginning to decline.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of the 1.1685 level while the MACD indicator is in overbought territory. This would limit the pair's upside potential and lead to a reversal downward. A decline toward the opposite levels of 1.1658 and 1.1603 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.