The GBP/USD pair once again traded quite calmly on Wednesday, which is not surprising given that only one report—the US Producer Price Index—was published during the day. Although this report triggered a strong market reaction a month ago, we warned in advance that the reaction would depend entirely on actual versus forecast data.

Still, while in recent weeks both major currency pairs have not delighted traders with trending moves, that doesn't mean there's a lack of news. Most headlines, of course, are tied to Donald Trump. For example, Trump is still trying to "put out" the Ukraine–Russia conflict, but knows no method other than tariffs and sanctions to achieve his goals. Remember, Trump is highly motivated to end the war between Kyiv and Moscow, as he wants to win the Nobel Peace Prize in October 2025. Just think about it: the president of the United States makes global geopolitical decisions to obtain a personal award. Such is the reality of 2025. Maybe we should just give Trump the title of "Lord of the World" or "Tsar of All the Earth?"

For the sake of "peace in Ukraine"—that is, the Nobel Prize—Trump will stop at nothing. He's willing to negotiate with Vladimir Putin and Vladimir Zelensky and also introduce tariffs against India to prevent it from buying Russian oil and gas. Simultaneously, he incites the EU to stop importing from Russia and pressures for sanctions against India and China. At the same time, Trump avoids directly confronting Russia, realizing that worsening relations with Moscow would further strengthen its ties with China and India. And together, these three countries occupy the lion's share of Eurasia. Even for America, facing such an alliance would be tough, so Trump is doing everything possible to prevent this.

With Trump, the United States is once again ready to become "friends" with Russia, to do business together, to develop side by side. And everyone understands Trump's real aim isn't friendship with Russia; instead, it's to prevent Russia from allying with India and China. The situation is both absurd and paradoxical, but that's reality.

Let's also not forget Lisa Cook. Trump fired Cook from her post on the Fed's Monetary Policy Committee a few weeks ago. Cook appealed to the US Supreme Court in Washington, which ordered that she be reinstated. In other words, the Court made it clear to Trump that he has not yet earned the award of being "The Arbiter of Fates" and needs to at least sometimes adhere to US law.

Also, recall that two courts in the US have already ruled that practically all of Trump's tariffs are illegal. Now it comes down to the Supreme Court, where Trump presumably has a season pass by now. If the Supreme Court also rules that the president's tariffs exceed his powers, they will be officially canceled. But how to unwind the web of tariffs and trade deals signed under those tariffs is anyone's guess. One thing is certain—there won't be a dull moment over the next three years.

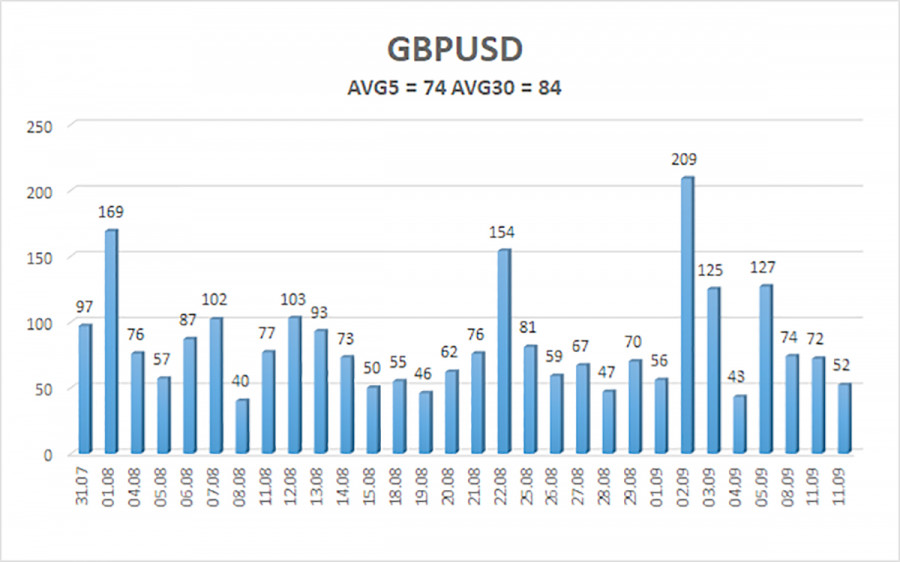

The average volatility for GBP/USD over the last five trading days is 74 pips, classified as "average" for this pair. On Thursday, September 11, we expect movement within the 1.3476–1.3624 range. The linear regression channel's upper band is pointing upward, indicating a clear uptrend. The CCI indicator has dropped into the oversold area again, warning of a likely resumption of the uptrend.

Nearest Support Levels:

S1 – 1.3489

S2 – 1.3428

S3 – 1.3367

Nearest Resistance Levels:

R1 – 1.3550

R2 – 1.3611

R3 – 1.3672

Trading Recommendations:

The GBP/USD pair is once again trying to resume its uptrend. In the medium term, Trump's policies will likely continue to pressure the dollar, so we do not expect dollar strength. Thus, long positions targeting 1.3611 and 1.3672 remain much more relevant when the price is above the moving average. If the price falls below the moving average, small shorts can be considered on purely technical grounds. Occasionally, the US currency shows corrections, but trend-strengthening for the dollar will require real signs that the global trade war is over, or other major positive factors.

Chart Elements Explained:

- Linear regression channels help determine the current trend. If both channels point in the same direction, the trend is strong.

- The moving average line (settings 20,0, smoothed) indicates the short-term trend and trade direction.

- Murray levels serve as target levels for moves and corrections.

- Volatility levels (red lines) are the likely price channel for the next day, based on current volatility readings.

- The CCI indicator: dips below -250 (oversold) or rises above +250 (overbought) mean a trend reversal may be near.