The EUR/USD currency pair traded relatively calmly on Thursday, yet it has risen significantly over the past two weeks. This movement can be interpreted in several ways. From a technical perspective, the uptrend remains intact, and after a correction, the bullish trend was expected to resume. From a fundamental standpoint, the market reacted to a U.S. credit rating downgrade, a controversial "tax cut" bill this week, and continued expectations of a slowdown in the U.S. economy. Additionally, there are no signs of trade negotiations between the U.S., the EU, and China. Combined, these factors likely triggered another wave of U.S. dollar selling.

Nevertheless, this week's macroeconomic calendar has been almost empty, which may have led some traders to feel there were no clear reasons for the dollar's decline. However, there are underlying reasons — just not immediately evident.

The PMI indices published yesterday will not be discussed in detail. It is enough to say that all readings in the Eurozone—including Germany—came in weaker and are now below the 50.0 mark, indicating contraction. Still, the euro only experienced a modest drop of 30–40 pips in the first half of the day. As previously warned, such reports can trigger a local reaction but are unlikely to shift trader sentiment to bearish or reverse the trend.

The European economy has been struggling for a long time, and Trump's tariffs only further weaken its outlook. The European Central Bank is doing everything it can to avoid a GDP contraction, but at best it can only prevent further deterioration, not stimulate growth. Yet, these facts do not directly influence the euro-dollar exchange rate. We've said it repeatedly — if not for Donald Trump, the euro would likely be near parity with the dollar. Even now, comparing the state of the European and U.S. economies or the monetary policies of the ECB and the Federal Reserve, it's clear that the dollar should not be falling.

Nonetheless, the market continues to sell off the U.S. currency, which resembles a personal protest against Trump. Foreign investors are increasingly opting for assets other than U.S. stocks and bonds. While domestic demand may cover the shortfall in foreign capital, the U.S. economy is becoming less attractive to foreign investors. So, even if U.S. domestic markets have recovered from the "initial shock," the global perception of the dollar, the U.S. economy, and its government have shifted significantly.

Therefore, considering all relevant factors (as one should), there are no real reasons for the dollar to fall. However, when viewing the situation realistically, the market continues to rebel against both the dollar and Trump.

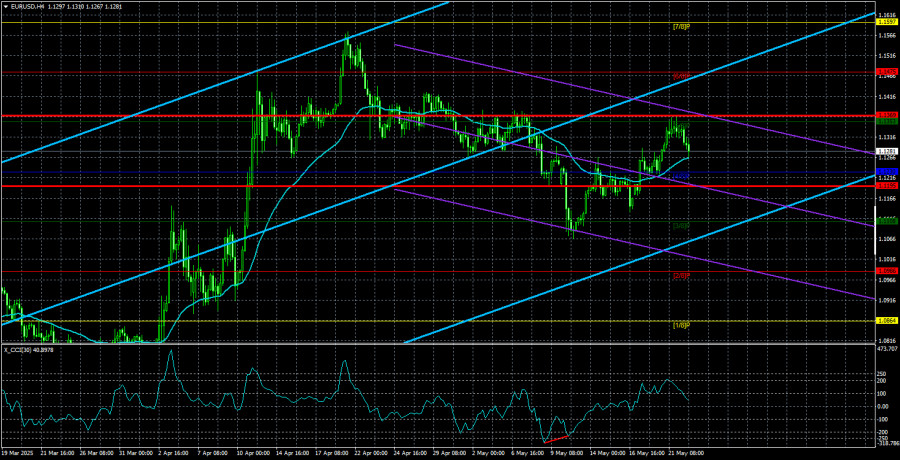

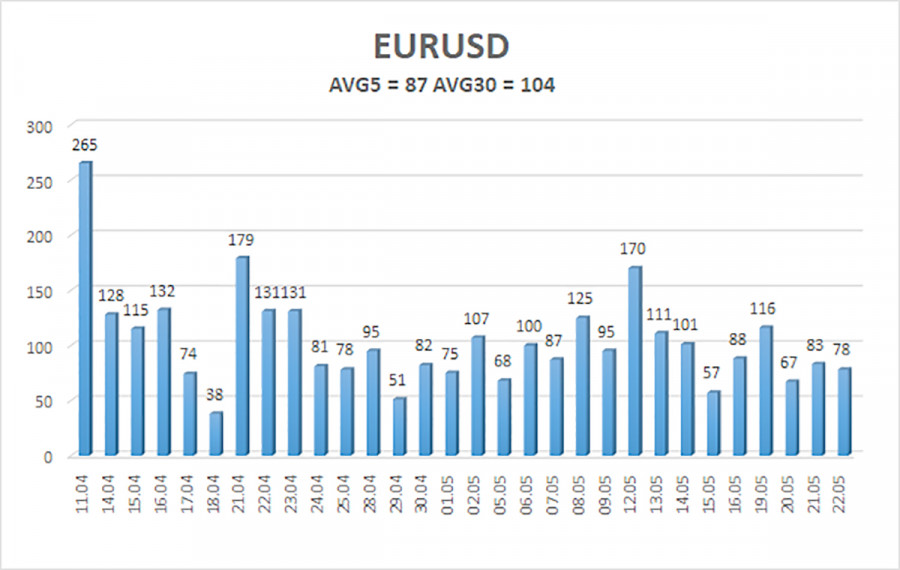

The average volatility of EUR/USD over the last five trading days as of May 23 is 87 pips, which is categorized as "moderate." We expect the pair to trade between 1.1195 and 1.1369 on Friday. The long-term regression channel is pointing upward, still indicating a bullish trend. The CCI indicator entered oversold territory, which — within an uptrend — suggests a trend resumption. Shortly after, a bullish divergence formed, triggering another wave of upward movement.

Nearest Support Levels:

S1: 1.1230

S2: 1.1108

S3: 1.0986

Nearest Resistance Levels:

R1: 1.1353

R2: 1.1475

R3: 1.1597

Trading Recommendations:

The EUR/USD pair is attempting to resume its upward trend. In recent months, we have consistently stated that we expect only a decline in the euro in the medium term, and as of now, nothing has changed. The dollar still has no fundamental reason to weaken, except for Trump's policies. The U.S. President has recently been leaning toward a trade truce, so the trade war factor may now support the U.S. currency. However, we continue to observe a complete reluctance from the market to buy the dollar, which appears to be a protest directed personally at Trump. Short positions remain relevant if the price is below the moving average, with targets at 1.1108 and 1.0986. If the price is above the moving average, long positions may be considered with targets at 1.1353 and 1.1369.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.