Tech Surge Propels Wall Street to New Heights

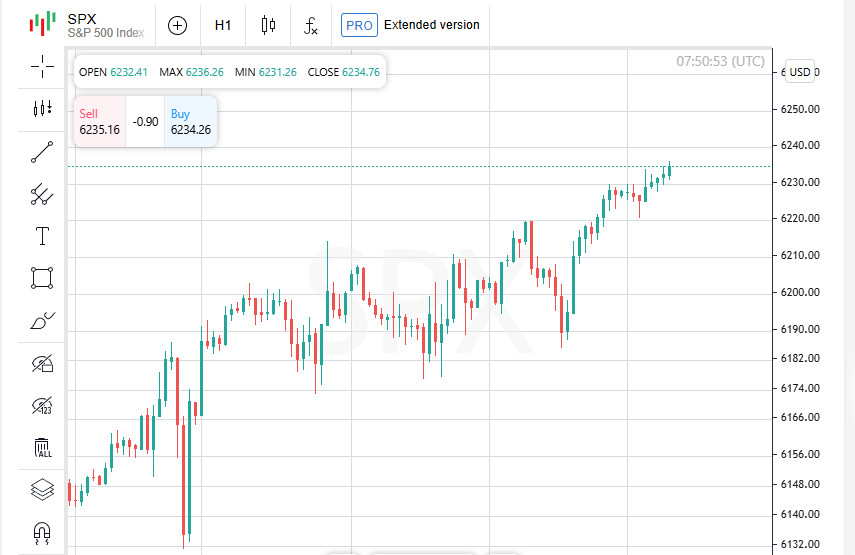

U.S. stock indices S&P 500 and Nasdaq closed at record highs on Wednesday, driven by a robust rally in tech stocks and a fresh trade deal between the United States and Vietnam. The agreement helped ease investor concerns over lingering global trade tensions.

Dow Dips Slightly, Yet Stays Near Peak

The Dow Jones Industrial Average edged down modestly by the end of the day, but remains within 1.18% of its all-time closing high from December 4. This reflects a market that remains largely buoyant amid ongoing macroeconomic uncertainty.

Investors Embrace Risk Amid Market Swings

Wall Street has seen a streak of record-breaking sessions in recent weeks. Despite fluctuating daily trends, investors appear undeterred, showing a strong appetite for risk even as inflation, budget deficits, and policy shifts remain unresolved.

Big Tech in the Spotlight: Nvidia, Apple, Tesla

Nasdaq reached another milestone on June 30, bolstered by standout performances from tech giants Nvidia, Apple, and Tesla. Tesla, in particular, drew attention due to the TSLL fund — a leveraged ETF offering double the daily returns of Tesla stock and popular among short-term traders.

Jobs Report in Focus as Fed Watch Continues

All eyes are now on Thursday's upcoming nonfarm payroll report. The data could provide key insights into when the Federal Reserve might move to reduce interest rates, a decision closely tied to labor market trends.

Trump's Fiscal Plan Heads to the House

On the legislative front, former President Donald Trump's sweeping tax and spending bill is on its way to the U.S. House of Representatives after Senate approval. Independent analysts warn the proposal could add $3.4 trillion to the national debt over the next decade.

Weak Start: Markets Dip on Surprise Jobs Data

Markets opened lower on Wednesday after an unexpected drop in U.S. private-sector job growth in June, coupled with a downward revision of May's employment figures. The disappointing labor data sparked early concerns about the resilience of the American job market.

Midday Rebound: Vietnam Deal Shifts Sentiment

Investor sentiment shifted dramatically by midday following the announcement of a trade deal between the United States and Vietnam. The agreement includes a 20 percent tariff on a wide range of Vietnamese exports — a clear signal of renewed U.S. trade assertiveness.

India on the Horizon

In a related move, the Trump administration hinted that a trade agreement with India could be finalized soon, though officials noted that other countries may not be ready before July 9. This uncertainty adds momentum and speculation to the evolving international trade landscape.

Market Close: Nasdaq and S&P Climb, Dow Dips

By the closing bell, the S&P 500 rose 29 points, a gain of 0.47 percent, finishing at 6227. The Nasdaq Composite advanced by nearly 1 percent, up 190 points to reach 20393. In contrast, the Dow Jones Industrial Average slipped slightly, down 10 points to settle at 44484.

Tesla Rallies Despite Weak Deliveries

Tesla shares jumped 5 percent in a surprising rebound after posting a sharp decline in vehicle deliveries for the second quarter. Still, some traders said the figures were not as dire as analysts had warned. Even with Wednesday's gains, Tesla stock remains down more than 20 percent year-to-date.

Centene Plunges on Forecast Withdrawal

The session brought grim news for Centene. The health insurer's stock nosedived 40 percent, hitting its lowest point in eight years. The company pulled its 2025 earnings outlook, citing fresh data that pointed to a significant drop in expected revenue from its health insurance marketplace plans.

Asian Markets Hold Steady as Investors Await Key U.S. Data

Asian equities showed muted movement on Thursday as investors adopted a cautious stance ahead of a pivotal U.S. employment report. The outcome could pave the way for an anticipated interest rate cut by the Federal Reserve. Simultaneously, market watchers are closely monitoring the fate of a sweeping tax and spending bill currently under congressional review in Washington.

Trump Sparks Rally: Wall Street Hits Fresh Highs

U.S. stock indices closed at record levels overnight following President Donald Trump's announcement of a new trade agreement with Vietnam. The deal includes a 20 percent tariff on Vietnamese exports to the United States — a notable reduction from the previously threatened 46 percent but still well above historical levels.

Vietnam Markets React with Mixed Signals

The Vietnamese stock index climbed 0.5 percent, reaching its highest point since April 2022. Yet, the national currency took a hit, with the dong depreciating to an all-time low of 26,229 against the dollar — a sign of mounting pressure on the country's monetary stability.

Tokyo and Seoul Face Trade Hurdles

Meanwhile, trade talks between Japan and the U.S. have reportedly stalled, with Tokyo citing its national interests. South Korea's President Lee Jae-myung commented Thursday that discussions on U.S. tariffs remain difficult and expressed doubt that a resolution could be reached before next Tuesday.

Regional Markets Mixed Across the Board

The MSCI index tracking Asia-Pacific shares outside Japan edged up 0.1 percent. In contrast, Japan's Nikkei slipped by the same margin. China's top blue-chip index rose 0.5 percent, while the Hang Seng index in Hong Kong fell by one percent.

China's Services Sector Slows Sharply

Adding to the uncertainty, new data out of China revealed that growth in the services industry decelerated to its slowest pace in nine months in June — raising fresh concerns about the strength of the country's post-pandemic economic recovery.

Futures Climb as Investors Brace for U.S. Jobs Report

During Thursday's Asian trading session, stock index futures posted modest gains. Nasdaq and S&P 500 futures rose by 0.1 percent, while EUROSTOXX 50 futures advanced by 0.2 percent. Market participants are now closely eyeing a key economic release from the United States that could have significant implications for future monetary policy.

All Eyes on Nonfarm Payrolls

Later today, attention will shift to the latest U.S. employment data. Economists expect the economy to have added around 110,000 jobs in June, with the unemployment rate ticking up to 4.3 percent. However, uncertainty looms after a surprising drop in private-sector employment — the first in two years — cast doubt on the labor market's momentum.

Rate Cut This Month? Markets Remain Skeptical

Futures linked to U.S. interest rates currently suggest only a 25 percent chance that the Federal Reserve will ease policy at its upcoming meeting. The central bank has so far resisted any cuts this year, maintaining a tight stance — a position that has once again drawn sharp criticism from President Donald Trump.

Trump Renews Attack on Fed Chair Powell

Trump has repeatedly demanded that Fed Chair Jerome Powell resign, accusing him of inaction as borrowing costs remain elevated. The president argues that interest rates should be slashed to just 1 percent, well below the current target range of 4.25 to 4.5 percent, especially amid signs of economic cooling.

Fed's Independence Under Threat, Say Fund Managers

A new survey by UBS released Thursday reveals growing concern among global reserve managers. Two-thirds believe the Fed's independence is at risk, and nearly half fear that a weakening rule of law in the United States could have long-term consequences for asset allocation strategies.

Treasury Market Tense Ahead of Jobs Data

The U.S. government bond market remained on edge Thursday as traders braced for a key labor report. A disappointing employment release could trigger a notable drop in yields. Anticipating such a scenario, the yield on 10-year Treasury notes declined by 3 basis points to 4.265 percent, while 2-year notes slipped by 2 basis points to 3.772 percent.

Dollar Holds Steady, Pound Extends Losses

The U.S. dollar hovered just above a three-year low, inching up 0.1 percent on the day to 96.872 on the index. The British pound fell a further 0.1 percent to 1.3626 dollars, extending the previous day's sharp 0.8 percent decline. The drop followed cooling concerns about the future of Finance Minister Rachel Reeves, which had earlier weighed heavily on the currency.

UK Debt Market Reacts to Policy Reversal

Investor anxiety over Britain's fiscal direction intensified after the government walked back proposed welfare reforms. The decision sparked a surge in gilt yields, which at one point jumped nearly 23 basis points — the sharpest rise since October 2022 — as markets reacted to fears of deteriorating fiscal discipline.

Oil Prices Ease After Iran-Driven Spike

Oil markets saw a modest retreat after a dramatic 3 percent overnight jump, prompted by Iran's decision to suspend cooperation with the United Nations nuclear watchdog. U.S. crude futures slipped by 0.7 percent to 66.93 dollars per barrel, while Brent dropped by 0.8 percent on the day.

Gold Slightly Down

Precious metals followed the broader trend, with gold ticking down 0.1 percent to trade at approximately 3352 dollars per ounce.