Trade analysis and recommendations for trading the Japanese yen

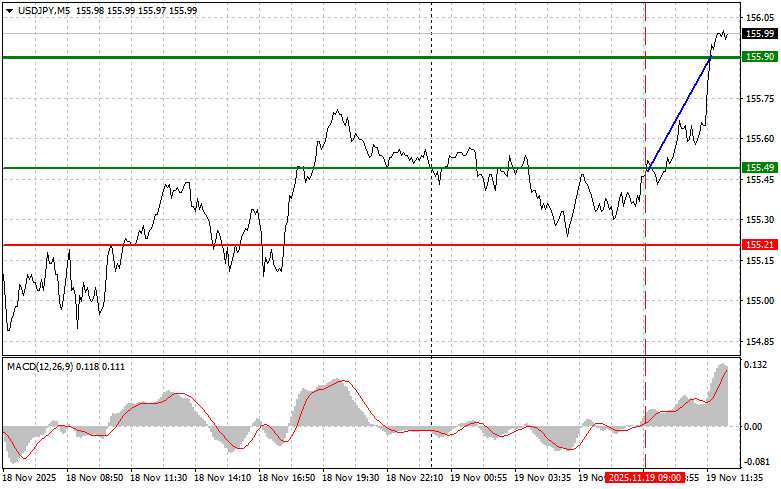

The test of the 155.49 price level occurred when the MACD indicator was just beginning to move up from the zero line, confirming a proper entry point to buy the U.S. dollar. As a result, the pair rose toward the target level of 155.90.

The Japanese yen weakened against the U.S. dollar following comments by Sanae Takaichi, a prominent member of the advisory council to the Prime Minister of Japan. Takaichi expressed the opinion that the Bank of Japan is unlikely to raise its key interest rate at least until March of next year. This is because the government needs to ensure the effectiveness of planned large-scale additional expenditures. Authorities want to be confident that these measures will actually stimulate domestic consumption.

Later in the day, market attention will focus on the release of the minutes from the most recent Federal Reserve meeting, as well as new data on the U.S. trade balance. Traders will analyze the Fed minutes in hopes of finding guidance on the future direction of monetary policy. Recall that at the beginning of November, policymakers cut interest rates by a quarter point, yet this did not help the yen regain its position against the U.S. dollar.

Trade balance statistics are also significant. An increase in the deficit may indicate weakening positions for U.S. producers in the international market, which in turn could negatively impact economic growth. Conversely, a reduction in the deficit may be seen as a positive sign of strengthening economic conditions.

For intraday strategy, I will mainly rely on the implementation of Scenarios No. 1 and No. 2.

Buy Signal

Scenario No. 1: I plan to buy USD/JPY today upon reaching the entry point around 156.06 (green line on the chart), targeting a rise to 156.56 (thicker green line on the chart). Near 156.56, I will exit long positions and open short positions in the opposite direction (expecting a 30–35 point reversal). Growth can be expected during the continuation of the bullish market.Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise.

Scenario No. 2: I also plan to buy USD/JPY today in case of two consecutive tests of 155.84 while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and trigger a reversal upward. Growth toward the opposite levels 156.09 and 156.56 can be expected.

Sell Signal

Scenario No. 1: I plan to sell USD/JPY today after breaking below 155.84 (red line on the chart), which should lead to a quick decline. The key target for sellers is 155.42, where I will exit shorts and immediately open long positions in the opposite direction (expecting a 20–25 point reversal). Pressure on the pair is unlikely to return today.Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to decline.

Scenario No. 2: I also plan to sell USD/JPY today in case of two consecutive tests of 156.09 while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and trigger a reversal downward. A decline to the opposite levels 155.84 and 155.42 can be expected.

What's on the chart:

- Thin green line – entry price for buying the instrument

- Thick green line – expected level to place Take Profit or lock in profits, as further growth above this level is unlikely

- Thin red line – entry price for selling the instrument

- Thick red line – expected level to place Take Profit or lock in profits, as further decline below this level is unlikely

- MACD indicator – when entering the market, it is important to rely on overbought and oversold zones

Important

Beginner Forex traders must make entry decisions very carefully. Before major fundamental reports are released, it is best to stay out of the market to avoid sudden price swings. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-loss orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

Remember, successful trading requires having a clear trading plan, like the one presented above. Spontaneous trading decisions based solely on the current market situation are, by definition, a losing strategy for any intraday trader.