The GBP/USD currency pair saw a slight increase last week, but overall volatility remains low. The market is still in a wait-and-see mode. The US dollar has no real reasons to grow, except for occasional corrections. The British pound has no reason to rise either, but it does have a trump card—the falling dollar. The British problems date back to 2016, when Brexit began. If you look at the current state of the British economy—issues with bonds and the budget, declining living standards, and so on—it's natural to wonder: why is the pound even rising at all? The pound rises because the dollar is falling, and there's no one else to strengthen it. The choices are limited.

This week, the pound might continue its undeserved upward march. In the UK, unemployment data will be released (currently 4.7%, higher than in the US, where the Federal Reserve is sounding the alarm about it), the consumer price index (currently 3.8%, forecast 3.9%, higher than in the US, where the Fed is likewise worried), and there will also be a Bank of England (BoE) meeting—after which the next monetary policy easing is likely a long way off. Unless the labor market, as in the US, keeps weakening. Since the BoE is unlikely to lower rates even once this year, and the Fed is expected to cut at least twice, we should expect the pair just to drift upward.

But the main point isn't even the actions of the Fed and BoE through year-end. The main point is market expectations for Fed and BoE policy for the next year or two. Right now, it's obvious to everyone that US rates will only head lower. If the Fed remains independent from Trump, the process will be gradual. If not, it could be rapid. Thus, the Fed will cut rates while the BoE keeps theirs steady. Should we expect the dollar to strengthen? As a bonus at the end of the week, August retail sales have shown a drop in seven of the past twelve months.

In the US, apart from the potentially surprise-filled Fed meeting, there will be reports on retail sales, industrial production, the construction sector, and real estate. All these are interesting releases, but they can only trigger local market moves. As we've said before, there are currently global factors that prevent us from counting on US dollar growth. And that's not even mentioning the trade war—a battle Trump could lose in the Supreme Court as soon as November, but he's unlikely to give in without a fight.

Therefore, whatever the outcomes of the Fed and BoE meetings or the data releases this week, we continue to expect only further growth for the pair. Technical corrections are possible, but for those, only technical analysis should be used. Right now, the pound is attempting to break through several recent local highs clustered at about the same level—and beyond that lies a high not seen in the past three years.

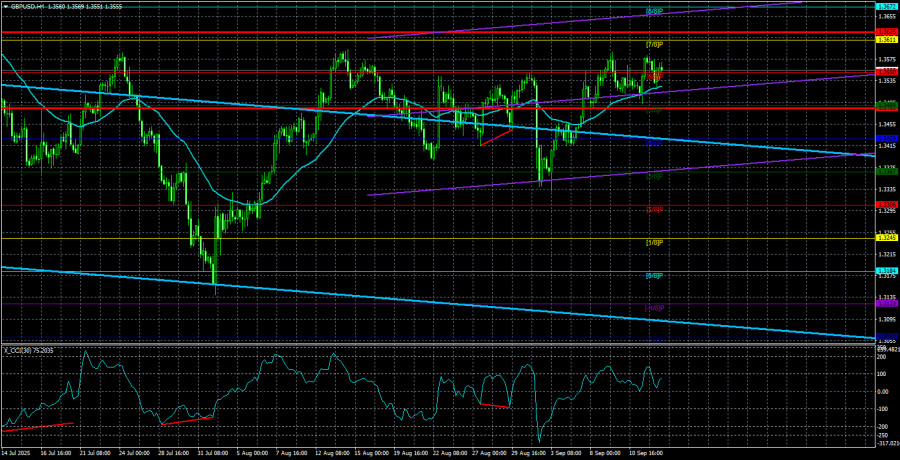

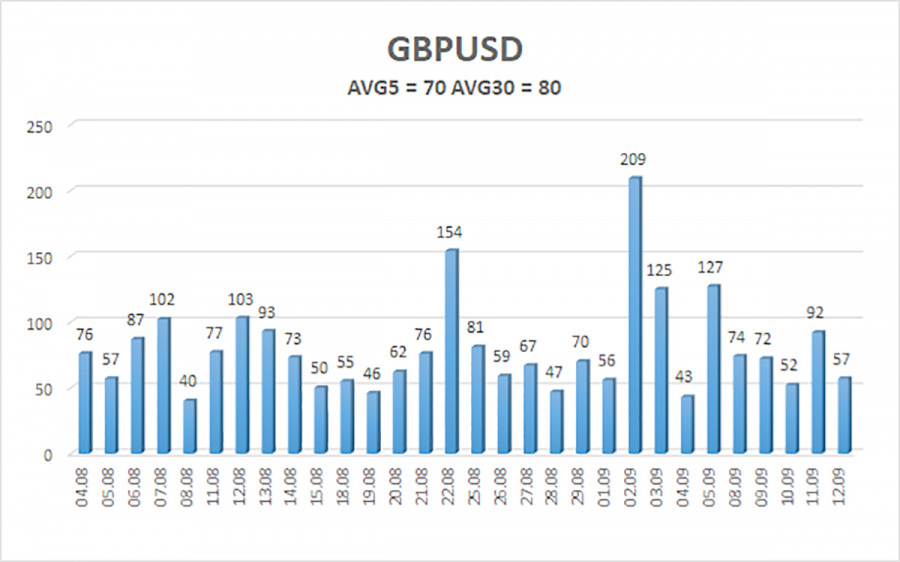

The average volatility of GBP/USD over the last five trading days is 70 pips. For the pound/dollar pair, this is considered "average." On Monday, September 14th, we expect the pair to stay within the range defined by levels 1.3485 and 1.3625. The linear regression channel's upper band is tilted upward, indicating a clear uptrend. The CCI indicator has again entered the oversold area, warning once more of a renewed upward trend.

Nearest Support Levels:

S1 – 1.3550

S2 – 1.3489

S3 – 1.3428

Nearest Resistance Levels:

R1 – 1.3611

R2 – 1.3672

R3 – 1.3733

Trading Recommendations:

The GBP/USD currency pair is once again aiming to continue its upward trend. In the medium term, Donald Trump's policies will likely continue to pressure the dollar, so we do not expect any growth from the greenback. Thus, long positions targeting 1.3611 and 1.3672 remain highly relevant as long as the price stays above the moving average. If the price drops below the moving average, small short positions can be considered on purely technical grounds. From time to time, the US currency shows corrective moves, but for a trend reversal and strengthening real signs of an end to the global trade war or other major positive factors are needed.

Chart Elements Explained:

- Linear regression channels help determine the current trend. If both channels point in the same direction, the trend is strong.

- The moving average line (settings 20,0, smoothed) indicates the short-term trend and trade direction.

- Murray levels serve as target levels for moves and corrections.

- Volatility levels (red lines) are the likely price channel for the next day, based on current volatility readings.

- The CCI indicator: dips below -250 (oversold) or rises above +250 (overbought) mean a trend reversal may be near.