Analysis of Wednesday's Trades

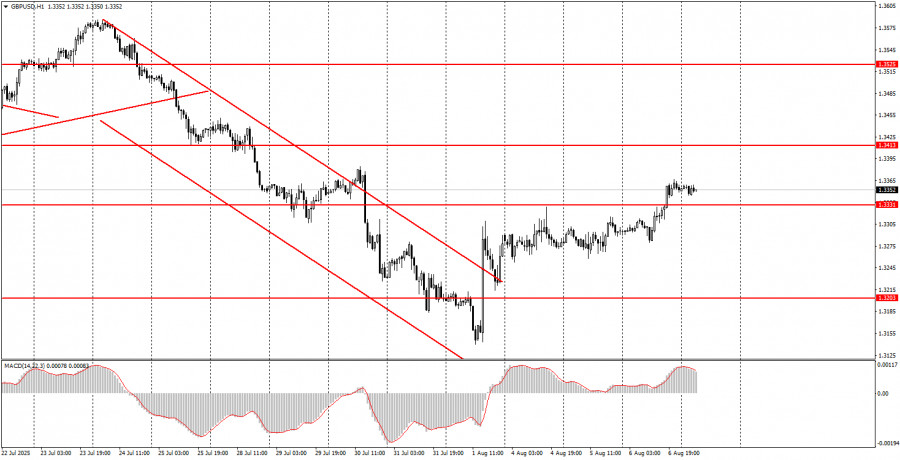

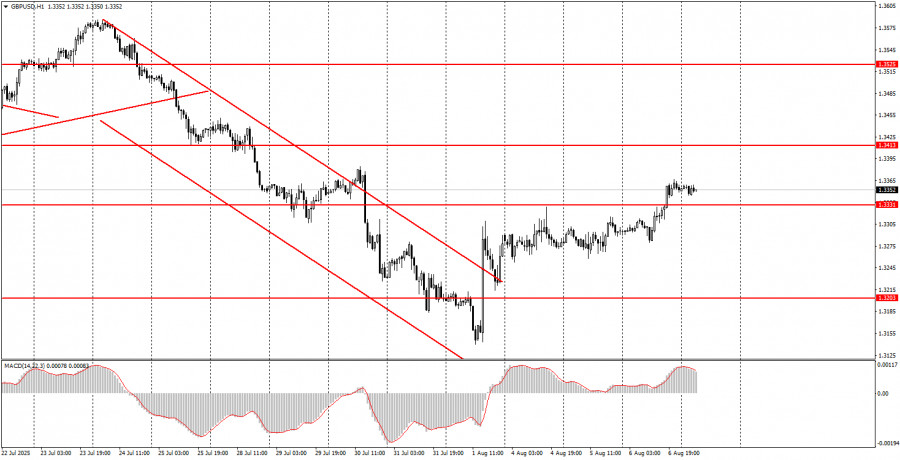

1H Chart of GBP/USD

The GBP/USD pair also continued its upward movement on Wednesday, for the same reasons as the EUR/USD pair. Donald Trump keeps firing officials he disapproves of, exerting such pressure on the Federal Reserve that FOMC members themselves are now ready to resign just to avoid dealing with the U.S. president. At the same time, Trump continues to impose tariffs on a significant portion of the world. In some cases, he's already going through a second or even third round. Tariffs are being layered on top of tariffs and generously seasoned with sanctions and threats. Naturally, few investors and traders are seriously considering buying the U.S. dollar. The U.S. economy may be growing by double digits, but other macroeconomic indicators are in decline. Thus, we still do not believe that the 2025 trend is over. Today, the Bank of England will hold a meeting, and the pound sterling may pull back slightly. However, in our view, this event will not affect the long-term outlook for the GBP/USD pair.

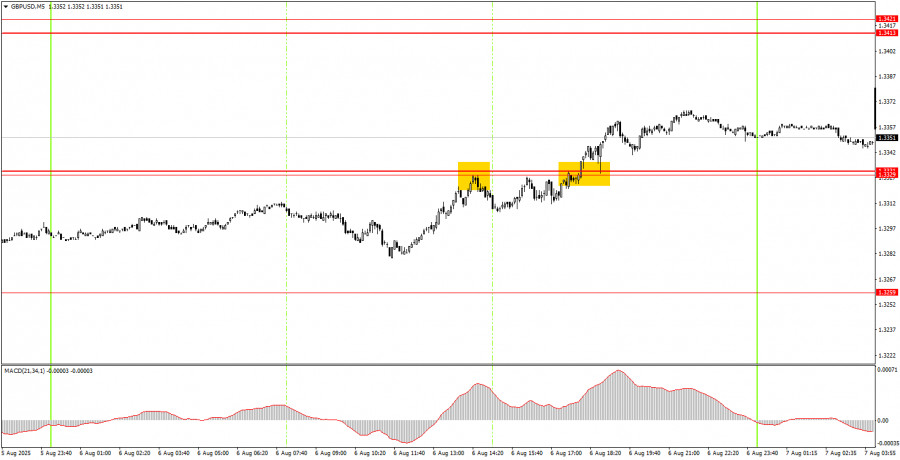

5M Chart of GBP/USD

On the 5-minute timeframe on Wednesday, two trading signals were formed. First, the pair bounced off the 1.3329–1.3331 area, but that sell signal turned out to be false. The price couldn't even drop by 20 pips. Then the area was broken, and the upward movement may well continue today. If any novice traders are currently holding long positions, they may simply set a breakeven Stop Loss, as the BoE meeting could trigger a drop in the British currency.

Trading Strategy for Thursday:

On the hourly timeframe, the GBP/USD pair shows that the downtrend has ended. After Friday's news, we wouldn't bet a penny on further dollar strength. The market isn't rushing to sell the dollar further, but why should it? The breakout above the descending channel has already occurred, meaning the trend on the 1H timeframe has shifted to an upward one.

On Thursday, the GBP/USD pair may continue moving upward. Therefore, any support level is potentially a bounce point and a chance to resume the move north. Yesterday, the price broke through the 1.3329–1.3331 area, which is already enough to expect further growth of the pound.

On the 5-minute TF, trading can now be done around the levels: 1.3102–1.3107, 1.3203–1.3211, 1.3259, 1.3329–1.3331, 1.3413–1.3421, 1.3466, 1.3518–1.3532, 1.3574–1.3590, 1.3643–1.3652, 1.3682, 1.3763.

The BoE meeting is scheduled for Thursday in the UK. Rates may be cut, which the market is, in principle, already prepared for. A drop in the pound cannot be ruled out, but overall, we continue to look north.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 20 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.