Analysis of Trades and Trading Tips for the Euro

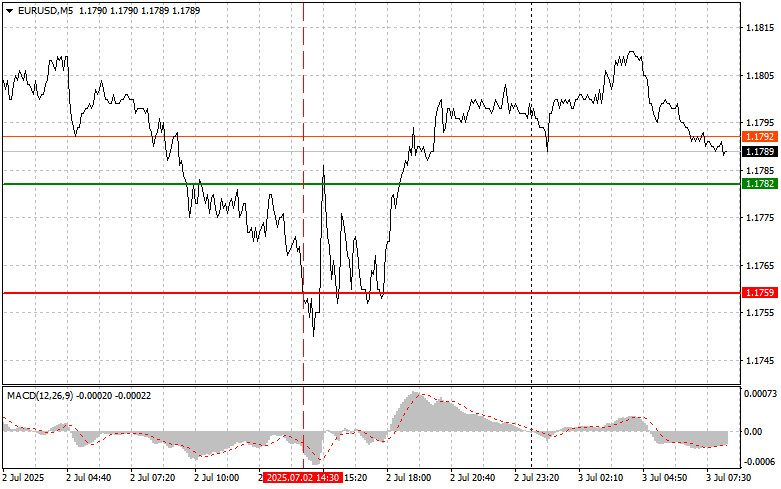

The test of the 1.1759 price level occurred when the MACD indicator had already moved significantly below the zero mark, which limited the pair's downward potential. For this reason, I did not sell the euro.

According to ADP Research, the U.S. private sector lost 33,000 jobs last month. This fact triggered a decline in the U.S. dollar and strengthened the euro. The drop in private employment reinforced concerns about a slowdown in the U.S. economy's growth, likely prompting the Federal Reserve to resume rate cuts in the near future. The main job losses were concentrated in small businesses, indicating potential difficulties in adapting to the changing economic environment. It's worth noting that despite the negative ADP numbers, they do not always entirely reflect the overall labor market. The official employment data, published by the U.S. Department of Labor, often differ from ADP data. These official figures are set to be released today, and we'll discuss them in more detail in the forecast for the second half of the day.

Meanwhile, during the European session, important PMI data for the services sector of the Eurozone countries is expected. Additionally, the European Central Bank's monetary policy meeting minutes will be published. Investors are closely watching these releases, as they could offer key insights into the Eurozone's current economic conditions and the European Central Bank's plans. The PMI indices are leading indicators of economic activity, reflecting the sentiment of purchasing managers across key industries. Meanwhile, the ECB's minutes will provide more detailed insights into the central bank's internal discussions. Special attention should be paid to the ECB's assessment of inflation risks and economic outlook.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

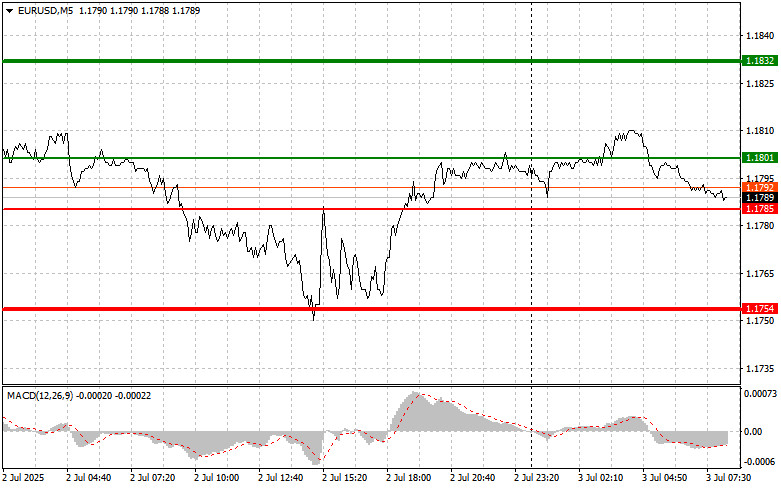

Scenario #1: Today, I plan to buy the euro at the price level of 1.1801 (indicated by the green line on the chart), with a target of 1.1832. At 1.1832, I plan to exit the market and open a short position in the opposite direction, expecting a 30–35 point reversal from the entry level. One can rely on euro growth today only after strong data.

Important: Before buying, ensure that the MACD indicator is above the zero line and is just beginning to rise from it.

Scenario #2: I also plan to buy the euro today in case of two consecutive tests of the 1.1785 price level, when the MACD indicator is in oversold territory. This will limit the pair's downside potential and trigger a market reversal to the upside. Growth toward the opposite levels of 1.1801 and 1.1832 can be expected.

Sell Scenario

Scenario #1: I plan to sell the euro once it reaches the 1.1785 level (indicated by the red line on the chart). The target will be 1.1754, at which point I will exit the market and buy immediately in the opposite direction, expecting a 20–25 point rebound. Downward pressure on the pair will likely return if the data is weak.

Important: Before selling, ensure the MACD indicator is below the zero line and is just beginning to decline from it.

Scenario #2: I also plan to sell the euro today in the event of two consecutive tests of the 1.1801 level, when the MACD indicator is in overbought territory. This will limit the pair's upside potential and cause a reversal to the downside. A decline toward the opposite levels of 1.1785 and 1.1754 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.