GBP/USD

Analysis: The British pound continues its downward movement, which began a month ago. After breaking a strong intermediate support level last week, the pair rebounded, forming a correction along that level. The wave structure indicates that the final segment (C) is still missing.

Forecast: A sideways trend is expected in the coming week within the corridor between the nearest counter-zones. An upward movement is more likely in the early part of the week. A reversal and resumption of the decline toward the support zone are expected near the calculated resistance area.

Potential Reversal Zones

- Resistance: 1.3460/1.3510

- Support: 1.3280/1.2800

Recommendations:

- Buying: Risky, possible in individual sessions using small volume sizes.

- Selling: Preferable after confirmed reversal signals near resistance.

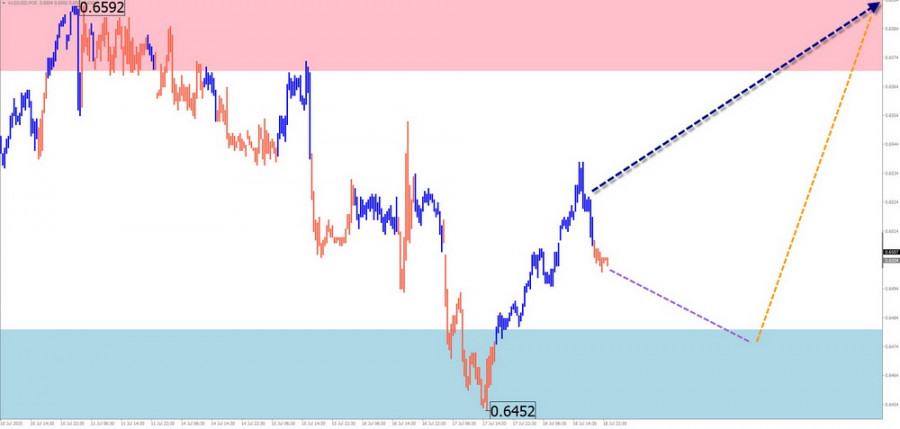

AUD/USD

Analysis:Since late June, an upward wave has been forming on the Australian dollar chart. In recent weeks, the price has been forming a horizontal corrective wave. The upward segment that began late last week is nearing completion and has reversal potential.

Forecast: Sideways movement is expected early in the week, with a decline toward the support zone. A reversal and resumption of the upward trend may follow. If the trend reverses, volatility may spike, potentially causing a brief breakout below support.

Potential Reversal Zones

- Resistance: 0.6570/0.6620

- Support: 0.6480/0.6430

Recommendations:

- Selling: No clear potential.

- Buying: Become relevant after confirmed reversal signals near support.

USD/CHF

Analysis: The downward wave that began at the start of the year continues to form in the USD/CHF chart. The latest segment started on May 12. A correction has been forming in recent weeks, but its structure is still incomplete.

Forecast: A sideways movement is expected throughout the week. Some pressure on the resistance zone may occur in the early days. A resumption of the downward trend is more likely toward the weekend. A breakout below the support zone is unlikely this week.

Potential Reversal Zones

- Resistance: 0.8040/0.8090

- Support: 0.7880/0.7830

Recommendations:

- Buying: Risky, only for intraday trades with small volume sizes.

- Selling: May become the primary strategy once your trading system confirms signals at reversal points.

EUR/JPY

Analysis: The short-term bullish wave pattern in the EUR/JPY pair that began on May 23 is still unfolding. Over the last two weeks, the price has been drifting sideways, forming a corrective pullback along a recently broken support/resistance level. The structure is now in its final phase.

Forecast: The first half of the week is expected to show a downward trend. A transition to a sideways range and a reversal could form near the support zone. A resumption of upward movement is more likely by the end of the week or shortly after.

Potential Reversal Zones

- Resistance: 174.20/174.70

- Support: 172.30/171.80

Recommendations:

- Selling: Very high risk; conservative traders should avoid entry.

- Buying: Can be used once confirmed reversal signals appear near support.

AUD/JPY

Analysis: Since early April, the AUD/JPY pair has been forming an upward wave. Over the past 1.5 months, price action has been mostly sideways, forming a shifting flat. The wave structure is not yet complete.

Forecast: A general sideways trend is likely at the beginning of the week, possibly with a decline toward support. A resumption of the upward trend is expected closer to the weekend. The calculated resistance zone aligns with the lower boundary of the preliminary target range for the current wave.

Potential Reversal Zones

- Resistance: 100.00/100.50

- Support: 96.00/95.50

Recommendations:

- Selling: Only suitable for intraday trades using small volumes; limited by support.

- Buying: Can become the main strategy after confirmed reversal signals near support.

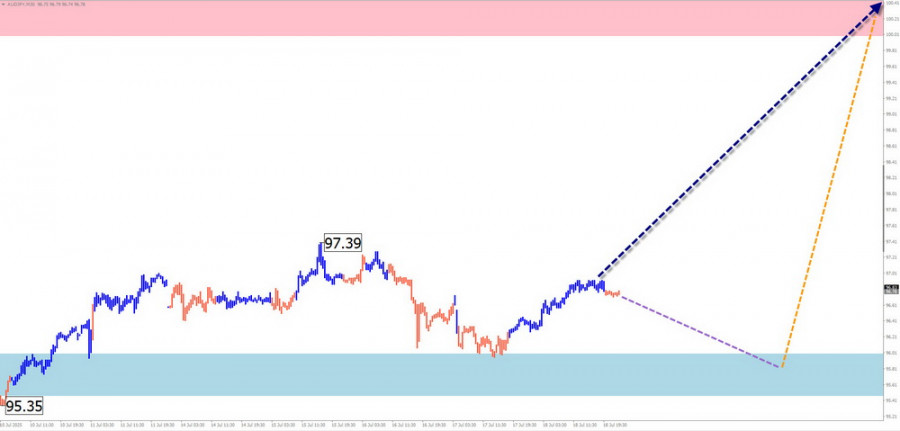

USD Dollar Index

Analysis: The US Dollar Index continues its downward trend that began in February. The latest segment started on May 12. Throughout the past month, a rising segment has formed within a sideways correction, and its structure is nearing completion.

Forecast: A continuation of the upward trend is expected in the coming days, potentially reaching the calculated resistance zone. In the second half of the week, a reversal is likely, followed by a return to the downward trend toward the support zone.

Potential Reversal Zones

- Resistance: 98.50/98.70

- Support: 97.10/96.90

Recommendations: The current temporary weakening of national currencies will likely be followed by another phase of strengthening. This weakening is expected to be short-lived, so traders should prepare for a longer period of buying national currencies.

Notes: In Simplified Wave Analysis (SWA), all waves consist of three parts (A-B-C). Only the last, unfinished wave is analyzed on each timeframe. Solid arrows indicate the formed structure; dashed arrows show expected movement.

Important: The wave algorithm does not account for the time duration of price movements.