Trade Review and Guidance for Trading the British Pound

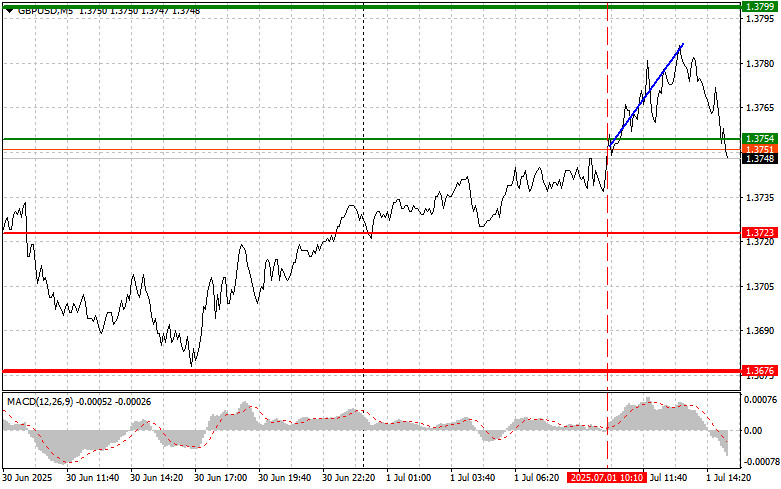

The test of the 1.3754 price occurred when the MACD indicator had just started moving up from the zero line, confirming a correct entry point for buying the pound and resulting in a more than 35-point rise in the pair.

The UK Manufacturing PMI matched economists' forecasts but remained below the 50-point mark, which limited the upward potential of the GBP/USD pair. The data confirmed concerns about a slowdown in the UK's economic growth, putting additional pressure on the pound sterling. As a result, investors are likely to pay closer attention to signs of a potential recession, as current figures do not inspire much optimism. Geopolitical instability also contributes to market caution. Rising inflationary pressure in the region further restrains GBP/USD's upward momentum.

In the second half of the day, we await a speech by Federal Reserve Chair Jerome Powell, along with the ISM Manufacturing PMI and the U.S. Job Openings and Labor Turnover Survey (JOLTS). These events will be key indicators that could significantly impact investor sentiment and currency market dynamics. Powell's comments will be closely scrutinized for any hints about the future path of monetary policy. Markets are looking for clarity regarding the pace of interest rate cuts and the Fed's stance on inflation. Any indication of a continued hawkish approach will likely strengthen the U.S. dollar, while dovish remarks could weaken it.

The ISM Manufacturing Index is a leading indicator of U.S. economic health. A reading above 50 indicates expansion in the manufacturing sector, while a reading below 50 signals contraction. A strong report may confirm economic resilience and support the dollar, whereas weak data could spark recession fears and pressure the U.S. currency.

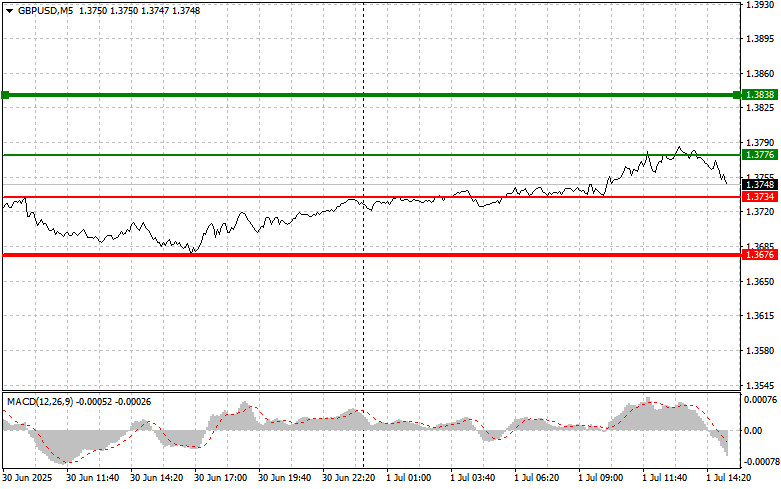

For today's intraday strategy, I'll be focusing on executing Buy and Sell Scenarios #1 and #2.

Buy Signal

Scenario #1:I plan to buy the pound today at the entry point around 1.3776 (green line on the chart), targeting a rise to 1.3838 (thicker green line). At 1.3838, I will exit long positions and open short positions in the opposite direction, targeting a 30–35 point correction from that level. This scenario assumes weak U.S. data.Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise.

Scenario #2:I also plan to buy the pound if there are two consecutive tests of the 1.3734 price level while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and trigger a reversal to the upside. The pair may rise toward the opposite levels at 1.3776 and 1.3838.

Sell Signal

Scenario #1:I plan to sell the pound today after a move below 1.3734 (red line on the chart), which would likely trigger a quick drop in the pair. The key target for sellers will be 1.3676, where I will exit short positions and immediately open long positions, aiming for a 20–25 point rebound from that level. Sellers are likely to become active in the event of strong U.S. data.Important! Before selling, make sure the MACD indicator is below the zero line and just beginning to decline.

Scenario #2:I also plan to sell the pound today if there are two consecutive tests of the 1.3776 level while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and trigger a reversal downward. A drop to 1.3734 and 1.3676 can be expected.

Chart Legend:

- Thin green line – Entry price to buy the trading instrument

- Thick green line – Estimated level for placing Take Profit or manually closing long trades, as further growth above this level is unlikely

- Thin red line – Entry price to sell the trading instrument

- Thick red line – Estimated level for placing Take Profit or manually closing short trades, as further decline below this level is unlikely

- MACD Indicator – Used to identify overbought and oversold conditions when entering the market

Important Note for Beginner Forex Traders:

Beginners should make entry decisions with great caution. It's best to stay out of the market ahead of major fundamental reports to avoid sharp price swings. If you choose to trade during news events, always use stop-loss orders to limit losses. Without stop-losses, you could quickly lose your entire account—especially if you don't apply money management and trade with large volumes.

Remember: successful trading requires a well-defined plan like the one outlined above. Making spontaneous decisions based on the current market situation is an inherently losing strategy for intraday traders.