یورو/امریکی ڈالر کے کرنسی کے جوڑے نے جمعہ کو معمولی کمی کے ساتھ تجارت کی، اور "پاگل اپریل" کے بعد مجموعی طور پر اتار چڑھاؤ میں کمی آئی ہے۔ امریکی ڈالر ایک ماہ سے زیادہ مضبوط ہو رہا ہے، حالانکہ یہ نمو کافی کمزور نظر آتی ہے۔ جب کہ ڈالر اپنی آزادانہ گراوٹ کو روکنے میں کامیاب ہو گیا ہے، اس کا نقطہ نظر غیر یقینی ہے اور زیادہ تر ڈونلڈ ٹرمپ اور عالمی تجارتی تنازعہ کے نتائج پر منحصر ہے۔ آئیے اسے توڑ دیں۔

ہم پہلے ہی کہہ چکے ہیں کہ اگر تجارتی جنگ میں کمی آتی رہتی ہے تو امریکی ڈالر کو مضبوط ہونا جاری رکھنا چاہیے۔ یہاں تک کہ ہم 1.03–1.04 رینج میں ڈالر کے اپنی اصل پوزیشن پر واپس آنے کے امکان کی بھی اجازت دیتے ہیں۔ آخر کار، ڈالر نے ان سطحوں سے اس وقت گرنا شروع کر دیا جب ٹرمپ نے امریکی اور عالمی معیشتوں دونوں کو دھمکی دیتے ہوئے ٹیرف کا نفاذ شروع کیا۔ ہو سکتا ہے عالمی معیشت کا ڈالر پر کوئی خاص اثر نہ پڑے لیکن امریکی معیشت ضرور متاثر کرتی ہے۔

دوسرے الفاظ میں، مارکیٹ نے کساد بازاری کے خدشے اور فیڈرل ریزرو کی جانب سے شرح میں نمایاں کمی کی وجہ سے ڈالر کو ڈبو دیا۔ تاہم، فرض کریں کہ ٹرمپ اور ان کی انتظامیہ "بلیک لسٹ" میں شامل تمام ممالک (خاص طور پر چین اور یورپی یونین) کے ساتھ تجارتی معاہدوں پر دستخط کرنے کا انتظام کرتی ہے۔ اس صورت میں، تجارت کی شرائط امریکہ کے لیے زیادہ سازگار ہو جائیں گی، یقیناً، ہمیں یہ نہیں بھولنا چاہیے کہ درآمدی محصولات لامحالہ امریکی برآمدات کے حجم کو کم کر دیں گے، زیادہ قیمتوں سے مانگ کم ہو جائے گی، اور مالیاتی لحاظ سے، امریکی معیشت کو نقصان پہنچے گا۔ تاہم، امریکی بجٹ کو آمدنی میں اضافے سے فائدہ ہوگا۔

یہ ایک پیچیدہ مسئلہ ہے، اور زیادہ تر ماہرین امریکی معیشت کی حالت کے بارے میں کئی ماہ یا ایک سال آگے پیشین گوئی کرنے سے گریز کرتے ہیں۔ یہاں تک کہ اگر ٹرمپ سازگار تجارتی سودے حاصل کر لیتے ہیں، تو کون کہے گا کہ وہ نئی تجارتی جنگ شروع نہیں کرے گا یا ایسے فیصلے نہیں کرے گا جس سے معیشت کو دوبارہ خطرہ ہو؟ یہ غیر یقینی صورتحال بالکل اسی وجہ سے ہے کہ تمام سازگار حالات موجود ہونے کے باوجود ڈالر اکثر بڑھنے میں ناکام رہتا ہے۔

لہذا، ہم سمجھتے ہیں کہ جیسے جیسے تجارتی جنگ میں کمی آتی جائے گی، ڈالر آہستہ آہستہ اور معمولی طور پر مضبوط ہوگا۔ فیڈرل ریزرو امریکی کرنسی کو بھی کچھ مدد فراہم کرتا ہے، کیونکہ اس کی مالیاتی پالیسی بدستور بدستور ہے۔ یورپی مرکزی بینک اور بینک آف انگلینڈ کے برعکس، اس نے شرحوں میں کمی نہیں کی ہے۔

ڈالر کے طویل مدتی امکانات کا انحصار مکمل طور پر ٹرمپ اور ان کے مستقبل کے فیصلوں پر ہے۔ اگر امریکی صدر عالمی نظم و ضبط کو برقرار رکھتے ہیں تو ڈالر دوبارہ گرنا شروع کر سکتا ہے۔ اب اس نتیجے کی توقع کرنے کی کوئی وجہ نہیں ہے، لہذا ہمیں یقین ہے کہ ڈالر کمزور اصلاحی اضافہ جاری رکھے گا۔ 4 گھنٹے کے چارٹ پر، قیمت حرکت پذیری اوسط سے نیچے رہتی ہے، جو نیچے کے رجحان کی نشاندہی کرتی ہے۔ بڑے اقتصادی پس منظر کو زیادہ تر تاجروں کی طرف سے نظر انداز کیا جا رہا ہے۔

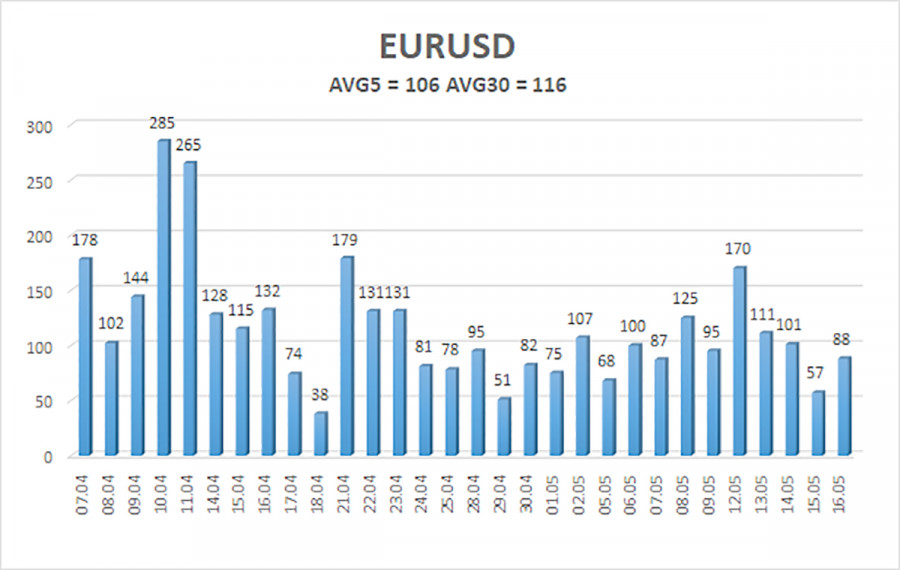

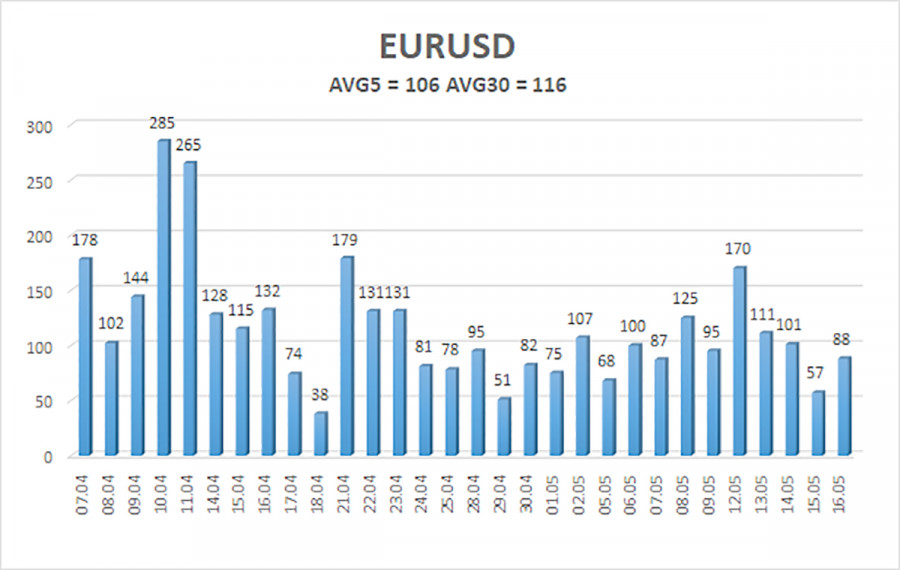

19 مئی تک گزشتہ پانچ تجارتی دنوں میں یورو/امریکی ڈالر جوڑے کی اوسط اتار چڑھاؤ 106 پپس ہے، جسے زیادہ سمجھا جاتا ہے۔ ہم توقع کرتے ہیں کہ جوڑی پیر کو 1.1059 اور 1.1271 کے درمیان چلے گی۔ طویل مدتی ریگریشن چینل اوپر کی طرف اشارہ کرتا ہے، جو کہ مختصر مدت کے اوپری رجحان کی نشاندہی کرتا ہے۔ CCI انڈیکیٹر حال ہی میں زیادہ فروخت ہونے والے علاقے میں ڈوب گیا، جو کہ ایک اوپری رجحان کے دوران، رجحان کے تسلسل کا اشارہ دیتا ہے۔ تاہم، تجارتی جنگ کا اب بھی تکنیکی اشارے سے قیمت کی نقل و حرکت پر بہت زیادہ اثر پڑتا ہے۔ تھوڑی دیر بعد تیزی کا انحراف پیدا ہوا، جس سے اوپر کی طرف ایک نیا جھول آیا۔

قریب ترین سپورٹ لیولز:

S1 – 1.1108

S2 – 1.0986

S3 – 1.0864

قریب ترین مزاحمتی سطح:

R1 – 1.1230

R2 – 1.1353

R3 – 1.1475

تجارتی سفارشات:

یورو/امریکی ڈالر کا جوڑا ایک وسیع تر اپ ٹرینڈ کے اندر نیچے کی طرف اصلاح جاری رکھے ہوئے ہے۔ کئی مہینوں سے، ہم نے مسلسل کہا ہے کہ ہمیں یورو میں درمیانی مدت کی کمی کی توقع ہے، اور یہ نقطہ نظر تبدیل نہیں ہوا ہے۔ ڈونلڈ ٹرمپ کے علاوہ، امریکی ڈالر کے اب بھی کمزور ہونے کی کوئی وجہ نہیں ہے۔ لیکن حال ہی میں، ٹرمپ تجارتی جنگ بندی کے لیے زور دے رہے ہیں، یعنی تجارتی جنگ کا عنصر اب ڈالر کی حمایت کرتا ہے، جو بالآخر 1.03 کے آس پاس کی سطح پر واپس آسکتا ہے۔ موجودہ حالات میں، لمبی پوزیشنیں متعلقہ نہیں ہیں۔ جب تک قیمت متحرک اوسط سے نیچے رہتی ہے، مختصر پوزیشنیں 1.1108 اور 1.1059 کے اہداف کے ساتھ متعلقہ رہیں گی۔

تصاویر کی وضاحت:

لکیری ریگریشن چینلز موجودہ رجحان کا تعین کرنے میں مدد کرتے ہیں۔ اگر دونوں چینلز منسلک ہیں، تو یہ ایک مضبوط رجحان کی نشاندہی کرتا ہے۔

موونگ ایوریج لائن (ترتیبات: 20,0، ہموار) مختصر مدت کے رجحان کی وضاحت کرتی ہے اور تجارتی سمت کی رہنمائی کرتی ہے۔

مرے لیول حرکت اور اصلاح کے لیے ہدف کی سطح کے طور پر کام کرتے ہیں۔

اتار چڑھاؤ کی سطحیں (سرخ لکیریں) موجودہ اتار چڑھاؤ کی ریڈنگز کی بنیاد پر اگلے 24 گھنٹوں کے دوران جوڑے کے لیے ممکنہ قیمت کی حد کی نمائندگی کرتی ہیں۔

CCI انڈیکیٹر: اگر یہ اوور سیلڈ ریجن (-250 سے نیچے) یا زیادہ خریدے ہوئے علاقے (+250 سے اوپر) میں داخل ہوتا ہے، تو یہ مخالف سمت میں آنے والے رجحان کو تبدیل کرنے کا اشارہ دیتا ہے۔