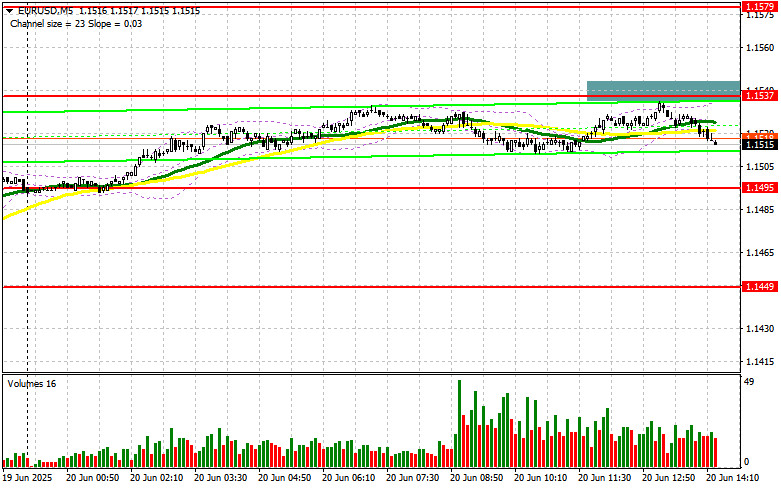

Dalam ramalan pagi, saya menekankan tahap 1.1537 dan merancang untuk membuat keputusan kemasukan pasaran berdasarkan tahap tersebut. Mari kita lihat carta 5 minit dan menganalisis apa yang berlaku di sana. Pasangan mata wang tersebut meningkat tetapi tidak mencapai beberapa mata, membentuk penembusan palsu di sekitar 1.1537, jadi tiada dagangan dilakukan pada separuh pertama hari tersebut. Pandangan teknikal untuk separuh kedua hari ini kekal tidak berubah.

Untuk Membuka Kedudukan Panjang pada pasangan EUR/USD:

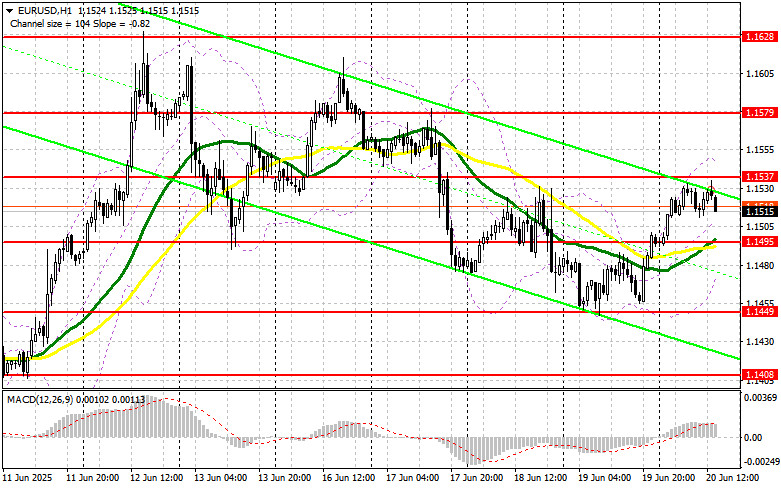

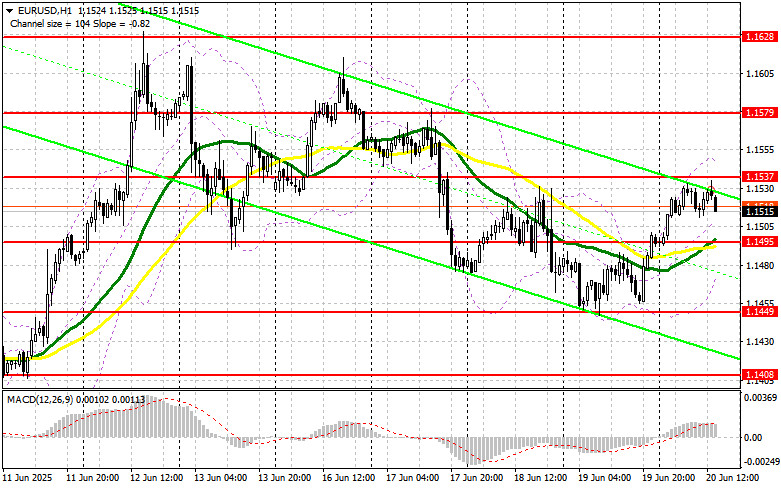

Data Indeks Harga Pengeluar (PPI) Jerman tidak memberi kesan besar kepada pasaran mata wang, seperti yang telah dijangkakan. Pada separuh kedua hari ini, tumpuan beralih kepada Indeks Pembuatan Fed Philadelphia dan Indeks Petunjuk Utama, namun sekali lagi, turun naik ketara tidak dijangka berlaku. Sekiranya euro menurun, saya akan bertindak berhampiran paras sokongan 1.1495. Jika berlaku penembusan palsu di paras tersebut, itu akan menjadi isyarat untuk membeli EUR/USD, dengan sasaran pemulihan dan pengujian semula paras rintangan 1.1537, yang belum disentuh pada awal hari ini. Penembusan dan ujian semula julat ini akan mengesahkan titik masuk yang sah dengan sasaran seterusnya di 1.1579. Sasaran akhir adalah pada 1.1628, di mana saya akan mengambil keuntungan. Jika EUR/USD terus menurun dan tiada aktiviti belian berhampiran 1.1495, tekanan ke atas pasangan ini akan meningkat, berpotensi mendorongnya turun ke 1.1449. Hanya selepas berlaku penembusan palsu di tahap tersebut barulah saya akan mempertimbangkan untuk membeli euro. Saya bercadang membuka kedudukan beli pada lantunan dari paras 1.1408, dengan sasaran pembetulan intraday sekitar 30–35 mata.

Untuk Membuka Kedudukan Pendek pada pasangan EUR/USD:

Penjual tidak menunjukkan banyak aktiviti pada separuh pertama hari ini. Diharapkan sesuatu yang menarik akan berlaku ketika sesi dagangan AS. Jika terdapat satu lagi cubaan untuk naik, penembusan palsu di sekitar 1.1537 akan menjadi alasan untuk membuka kedudukan jual dengan sasaran penurunan ke paras sokongan 1.1495, di mana purata bergerak—yang kini memihak kepada pembeli—terletak. Penembusan dan pengukuhan di bawah julat ini akan menjadi isyarat jual yang sah, dengan sasaran ke arah 1.1449. Sasaran akhir adalah pada 1.1408, di mana saya akan mengambil keuntungan. Sekiranya pasangan EUR/USD terus naik pada separuh kedua hari ini dan pergerakan menurun masih tidak aktif berhampiran 1.1537, pembeli mungkin akan mendorong peningkatan yang lebih besar menjelang akhir minggu, dengan potensi penembusan paras 1.1579. Saya hanya akan menjual di paras tersebut sekiranya berlaku penembusan yang gagal. Saya bercadang untuk membuka kedudukan jual pada lantunan dari 1.1628, dengan sasaran pembetulan menurun sekitar 30–35 mata.

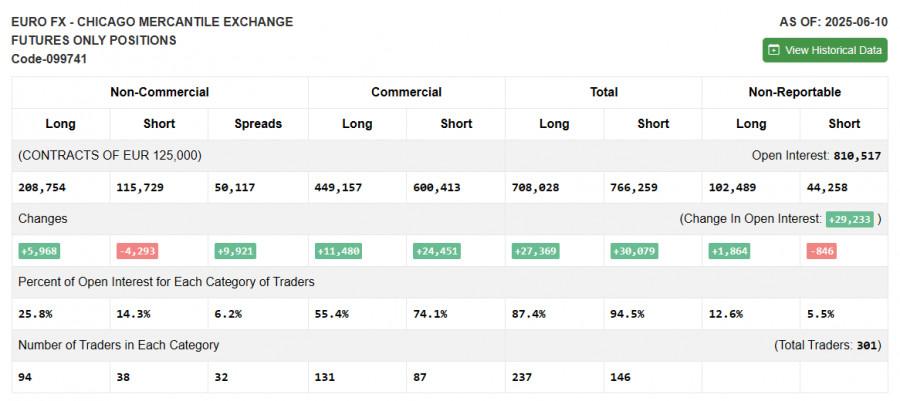

Laporan Commitment of Traders (COT) bagi 10 Jun menunjukkan pengurangan dalam kedudukan jual dan peningkatan dalam kedudukan beli. Kejatuhan mendadak dalam inflasi AS gagal menyokong dolar, meskipun terdapat petunjuk jelas bahawa Rizab Persekutuan (Fed) berkemungkinan besar akan mengekalkan kadar faedah tidak berubah dalam tempoh terdekat. Apa yang lebih penting ialah bagaimana Pengerusi Fed, Jerome Powell, akan mengulas mengenai situasi inflasi serta unjuran beliau terhadap pemotongan kadar faedah pada musim luruh ini. Faktor ini akan menentukan hala tuju seterusnya bagi pasangan EUR/USD, yang ketika ini tidak menunjukkan sebarang tanda kelemahan dalam pertumbuhan—seperti yang turut disahkan oleh laporan berkenaan. Laporan COT menunjukkan bahawa kedudukan beli bukan komersial meningkat sebanyak 5,968 kepada 208,754, manakala kedudukan jual bukan komersial menurun sebanyak 4,293 kepada 115,729. Akibatnya, jurang antara kedudukan beli dan jual melebar sebanyak 9,921.

Isyarat Penunjuk:

Dagangan Purata Bergerak sedang berlaku di atas purata bergerak 30 dan 50 tempoh, menunjukkan pertumbuhan berterusan euro.

Nota: Tempoh dan harga purata bergerak dianalisis oleh pengarang pada carta H1 sejam dan mungkin berbeza daripada purata bergerak harian klasik pada carta D1.

Bollinger Bands Dalam kes penurunan, sempadan bawah penunjuk berhampiran 1.1465 akan bertindak sebagai sokongan.

Penerangan Penunjuk:

- Purata Bergerak – Meratakan volatiliti dan gangguan pasaran bagi menentukan trend semasa. Tempoh – 50 (warna kuning pada carta); Tempoh – 30 (warna hijau pada carta).

- MACD (Purata Bergerak Penumpuan/Perbezaan) – Tempoh EMA pantas: 12; Tempoh EMA perlahan: 26; Tempoh garisan isyarat SMA: 9.

- Bollinger Bands – Tempoh: 20.

- Pedagang Bukan Komersial – Spekulator seperti pedagang individu, dana lindung nilai, dan institusi besar yang menggunakan pasaran niaga hadapan untuk tujuan spekulatif serta memenuhi kriteria tertentu.

- Kedudukan Beli Bukan Komersial – Jumlah keseluruhan kedudukan terbuka beli yang dipegang oleh pedagang bukan komersial.

- Kedudukan Jual Bukan Komersial – Jumlah keseluruhan kedudukan terbuka jual yang dipegang oleh pedagang bukan komersial.

- Kedudukan Bersih Bukan Komersial – Perbezaan antara kedudukan jual dan beli pedagang bukan komersial.