Trade Analysis and Advice on Trading the British Pound

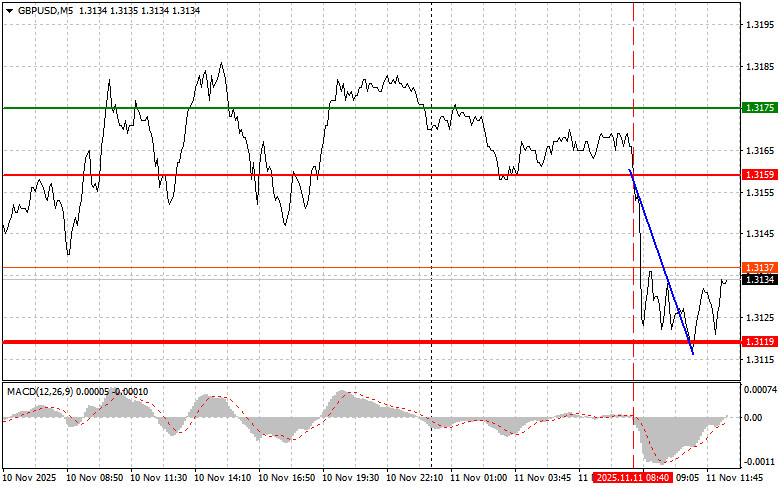

The test of the 1.3159 price occurred when the MACD indicator had just started moving down from the zero mark, confirming a valid entry point for selling the pound. As a result, the pair declined toward the target level of 1.3119.

News that the UK unemployment rate jumped to 5.0% and that wage growth slowed led to a fall in the pound during the first half of the day. The market reacted instantly: traders began selling the British currency, fearing further economic weakening. The slowdown in wage growth, coupled with rising unemployment, creates a toxic mix that puts pressure on consumer demand. The labor market data released today significantly worsens the outlook for the upcoming Bank of England meeting, reinforcing expectations that the regulator may ease monetary policy — which, in turn, adds additional pressure on the pound.

In the second half of the day, the only significant event will be the release of the NFIB Small Business Optimism Index in the U.S., so strong GBP/USD fluctuations are unlikely. While the NFIB indicator is not a top-tier economic metric, it reflects general sentiment in the small business sector, which plays an important role in the U.S. economy. Improving optimism may indirectly strengthen the dollar by signaling business confidence in economic growth. Conversely, weaker data could pressure the U.S. currency. It's also worth remembering that the market is constantly influenced by various factors that can trigger sudden volatility — for example, geopolitical events or unexpected statements from central bank officials.

As for the intraday strategy, I will rely mainly on Scenarios #1 and #2.

Buy Signal

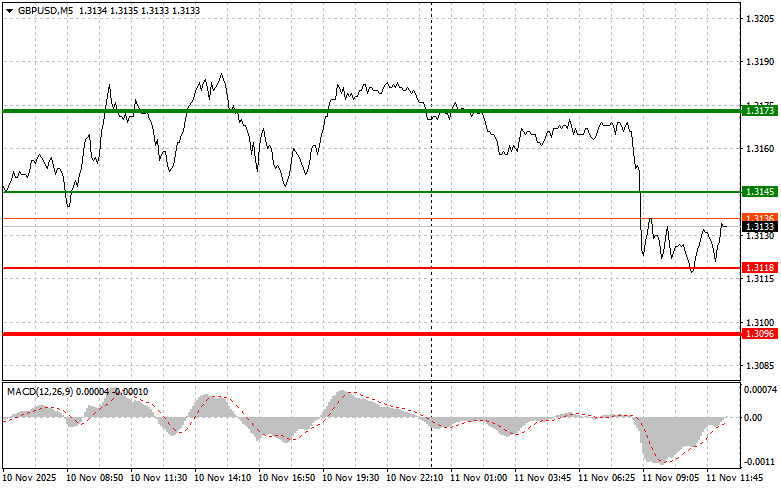

Scenario #1: Today, I plan to buy the pound when the price reaches the entry point around 1.3145 (green line on the chart), aiming for growth toward 1.3173 (the thicker green line on the chart). Near 1.3173, I plan to exit long positions and open short positions in the opposite direction, targeting a 30–35 point move from the level. A rise in the pound today can be expected only if U.S. data turns out very weak.Important! Before buying, make sure the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the 1.3118 price level while the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upward. Growth toward the opposite levels of 1.3145 and 1.3173 can then be expected.

Sell Signal

Scenario #1: Today, I plan to sell the pound after it updates the 1.3118 level (red line on the chart), which should trigger a rapid decline in the pair. The key target for sellers will be 1.3096, where I plan to exit short positions and immediately open long ones in the opposite direction (expecting a 20–25 point move back from the level). The pound could fall further if U.S. statistics come out strong.Important! Before selling, make sure the MACD indicator is below the zero mark and just starting to move down from it.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of the 1.3145 price level while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline toward the opposite levels of 1.3118 and 1.3096 can be expected.

Chart Explanation

- Thin green line – Entry price level for buying the trading instrument.

- Thick green line – Expected level where you can place a Take Profit or manually lock in profits, as further growth above this level is unlikely.

- Thin red line – Entry price level for selling the trading instrument.

- Thick red line – Expected level where you can place a Take Profit or manually lock in profits, as further decline below this level is unlikely.

- MACD indicator – When entering the market, it is important to be guided by overbought and oversold zones.

Important Note for Beginners

Beginner Forex traders must make entry decisions with great caution. Before the release of important fundamental reports, it's best to stay out of the market to avoid sudden price swings. If you decide to trade during news releases, always use stop orders to minimize losses. Without stop-loss orders, you can very quickly lose your entire deposit — especially if you neglect money management and trade with large volumes.

And remember: successful trading requires a clear trading plan, like the example provided above. Spontaneous trading decisions based on the current market situation are an inherently losing strategy for intraday traders.