Trade review and tips for trading the Japanese yen

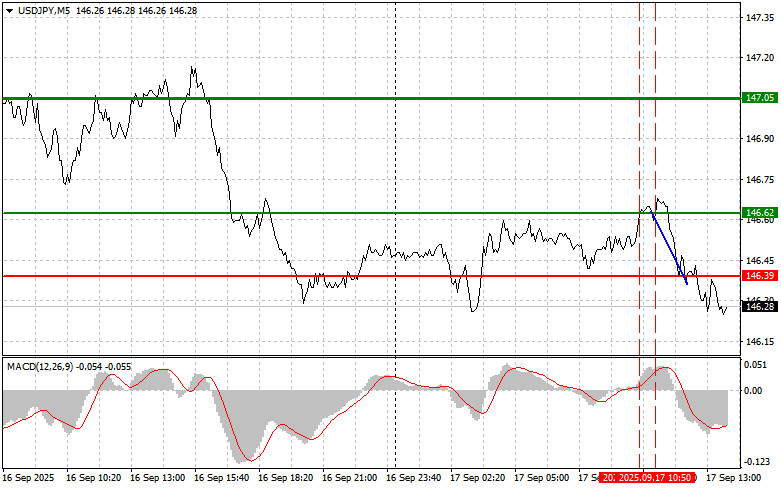

The price test of 146.62 in the first half of the day occurred when the MACD indicator had already moved far above the zero mark, which limited the pair's upward potential. The second test of 146.62, when the MACD was in the overbought area, led to the execution of sell scenario #2 and a 30-point drop in the yen.

In the second half of the day, everything depends on the FOMC. The key interest rate will be announced, the committee's economic review will be published, and then Jerome Powell's press conference will take place. The recent unstable economic situation in the country makes the FOMC's decision a powerful factor capable of causing significant swings in financial markets. A rate cut and signals of similar policy in the future would lead to a sharp weakening of the dollar and strengthening of the Japanese yen. Apart from the rate decision itself, special attention will be paid to the FOMC's economic projections. This document will provide insight into how committee members see the future of the economy, including growth, inflation, and employment prospects. Any mismatch between the FOMC's outlook and market expectations could trigger volatility and repricing of assets.

Fed Chair Jerome Powell's press conference is today's most important event. Given that today's debates are mainly focused on possible monetary easing, with signs of slowing economic growth and subdued inflation, many market participants expect Powell to strike a dovish tone, which would be negative for the dollar and positive for the yen.

As for intraday strategy, I will rely mainly on implementing scenarios #1 and #2.

Buy signal

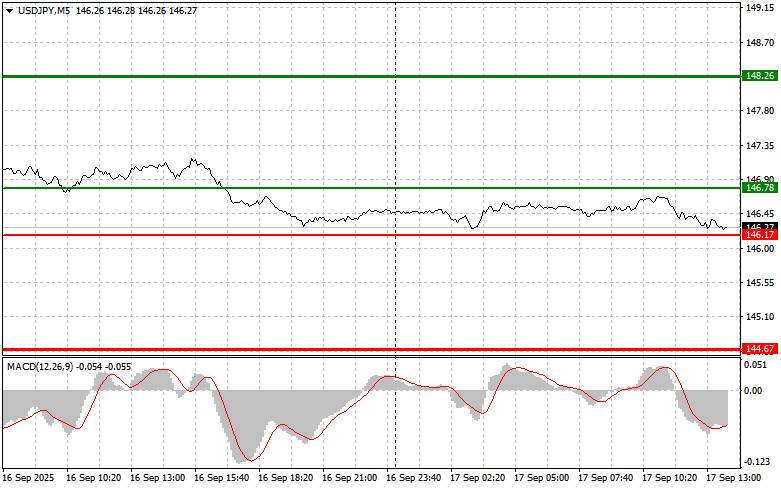

Scenario #1: Today I plan to buy USD/JPY at the entry point around 146.78 (green line on the chart), targeting growth to 148.26 (thicker green line on the chart). Around 148.26 I will exit purchases and open sales in the opposite direction (expecting a 30–35-point move back from the level). Growth in the pair can be expected only after a firm Fed stance. Important! Before buying, make sure the MACD indicator is above zero and just starting to rise from it.

Scenario #2: I also plan to buy USD/JPY today in case of two consecutive tests of the 146.17 level when the MACD indicator is in oversold territory. This will limit the pair's downward potential and trigger a reversal upward. Growth can be expected toward the opposite levels of 146.78 and 148.26.

Sell signal

Scenario #1: I plan to sell USD/JPY today after breaking below 146.17 (red line on the chart), which will lead to a quick decline in the pair. The key target for sellers will be 144.67, where I will exit sales and immediately open purchases in the opposite direction (expecting a 20–25-point move back from the level). Pressure on the pair will return today if the Fed strikes a dovish tone. Important! Before selling, make sure the MACD indicator is below zero and just starting to move downward.

Scenario #2: I also plan to sell USD/JPY today in case of two consecutive tests of the 146.78 level when the MACD indicator is in overbought territory. This will limit the pair's upward potential and trigger a reversal downward. A decline can be expected toward the opposite levels of 146.17 and 146.77.

What's on the chart:

- Thin green line – entry price for buying the instrument;

- Thick green line – estimated price where Take Profit can be set or profits fixed manually, as further growth above this level is unlikely;

- Thin red line – entry price for selling the instrument;

- Thick red line – estimated price where Take Profit can be set or profits fixed manually, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to follow overbought and oversold zones.

Important. Beginner Forex traders must make entry decisions with great caution. Before the release of important fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can very quickly lose your entire deposit, especially if you neglect money management and trade in large volumes.

And remember, successful trading requires a clear trading plan, like the one I presented above. Making spontaneous decisions based on the current market situation is initially a losing strategy for an intraday trader.