Analysis of Trades and Trading Tips for the Japanese Yen

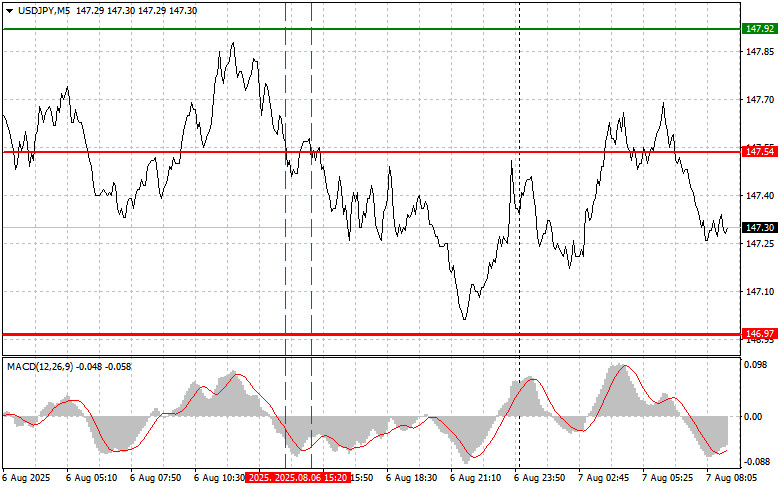

The first test of the 147.54 level occurred when the MACD indicator had already moved significantly below the zero line, which limited the pair's downside potential. For this reason, I did not sell the dollar. The second test of 147.54 coincided with the MACD being in the oversold zone, which allowed Scenario #2 for buying the dollar to be triggered — however, the pair failed to rise, resulting in a stop-out and a realized loss.

Today's solid report on Japan's Leading Economic Index helped the yen slightly strengthen against the dollar. This was a welcome boost for the Japanese currency, which had already shown decent gains against the dollar yesterday following speeches by several Federal Reserve officials. The Leading Economic Index serves as a barometer forecasting future economic activity. Its increase indicates potential acceleration in Japan's economic growth, thereby enhancing the yen's appeal to investors. Today's data confirmed that Japan's economy, despite global challenges, retains some forward momentum.

However, the impact of a single report should not be overstated. A sustainable strengthening of the yen would require more fundamental shifts. Inflation dynamics and the Bank of Japan's monetary policy decisions will play a key role. For now, interest rate hikes remain on hold, and the central bank has issued no new guidance.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

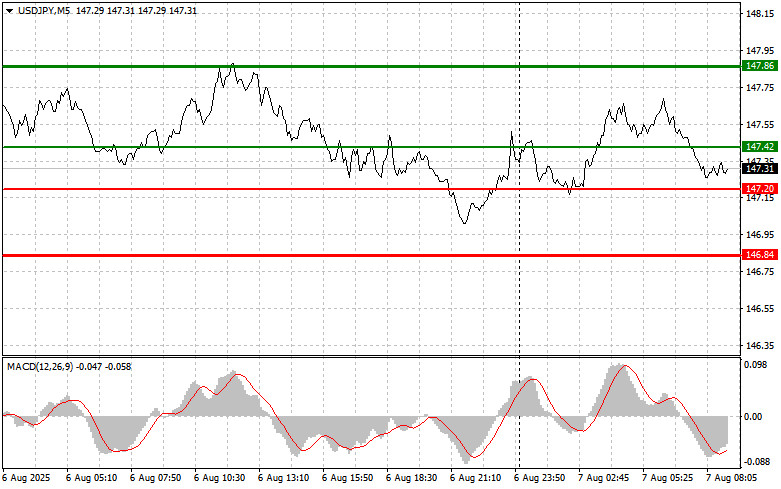

Scenario #1: I plan to buy USD/JPY today upon reaching the entry point around 147.42 (green line on the chart), targeting a rise to 147.86 (thicker green line on the chart). Around 147.86, I plan to exit long positions and open short positions in the opposite direction (anticipating a 30–35 point pullback from that level). It's best to re-enter long positions on corrections and deep pullbacks in USD/JPY.

Important: Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy USD/JPY today if there are two consecutive tests of the 147.20 level while the MACD indicator is in the oversold zone. This would limit the pair's downside potential and trigger a market reversal upward. A rise toward the opposite levels of 147.42 and 147.86 can be expected.

Sell Scenario

Scenario #1: I plan to sell USD/JPY today only after a breakout below 147.20 (red line on the chart), which would likely lead to a rapid drop in the pair. The sellers' key target will be the 146.84 level, where I plan to exit shorts and immediately open long positions in the opposite direction (anticipating a 20–25 point bounce from that level). It's best to sell as high as possible.

Important: Before selling, ensure that the MACD indicator is below the zero line and just beginning to decline.

Scenario #2: I also plan to sell USD/JPY today in case of two consecutive tests of the 147.42 level while the MACD indicator is in the overbought zone. This would limit the pair's upward potential and result in a downward reversal. A decline toward the opposite levels of 147.20 and 146.84 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.