Analysis of Trades and Trading Tips for the British Pound

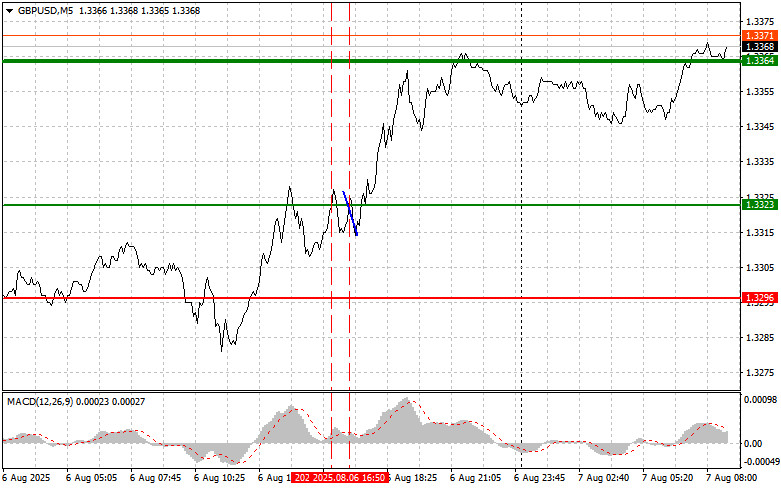

The test of the 1.3323 level occurred when the MACD indicator had already risen significantly above the zero line, which limited the pair's upside potential. The second test of 1.3323 coincided with a decline in the MACD from the overbought zone, allowing Scenario #2 for selling to be realized. However, the pair failed to fall, resulting in a stop-out and loss.

Yesterday's statements by U.S. Federal Reserve officials regarding the troubling condition of the U.S. labor market — hinting at a possible rate cut as early as September — led to a decline in the dollar. Such unanimous concern from senior officials immediately put pressure on the dollar, allowing pound buyers to re-enter the market.

This morning, the Bank of England will announce its key interest rate decision, followed by a speech from BoE Governor Andrew Bailey. These events will undoubtedly have a significant impact on the short- and medium-term outlook for the British currency. The interest rate decision is perhaps one of the most anticipated events for financial markets. A rate cut will immediately affect the pound's dynamics, although it's worth noting that the market has already priced in this policy change. Only fresh hints at an even more dovish policy stance would trigger further pound weakness.

Equally important is the upcoming speech by Andrew Bailey. The BoE Governor usually uses such opportunities to clarify the central bank's stance, assess the current economic situation, and share forecasts. Investors will closely analyze his tone, looking for any hints about possible changes to BoE policy. A dovish tone could shift traders' perception of the pound's outlook, weakening it against the dollar.

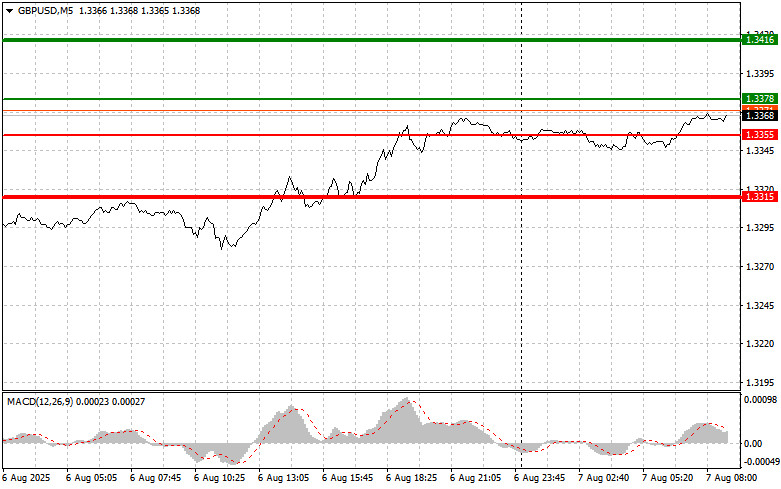

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Scenario

Scenario #1: I plan to buy the pound today at the entry point around 1.3378 (green line on the chart), with a target of rising to 1.3416 (the thicker green line on the chart). Around 1.3416, I plan to exit the buy position and open a short position in the opposite direction (aiming for a 30–35 point retracement from that level). Buying the pound today is only advisable after a hawkish stance from the BoE.

Important: Before buying, ensure that the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the pound today in case of two consecutive tests of the 1.3355 level while the MACD indicator is in the oversold zone. This would limit the pair's downside potential and lead to an upward reversal. A rise toward the opposite levels of 1.3378 and 1.3416 can be expected.

Sell Scenario

Scenario #1: I plan to sell the pound today after the 1.3355 level is broken (red line on the chart), which would likely result in a sharp drop in the pair. The sellers' key target will be the 1.3315 level, where I plan to exit the sell position and immediately open a long position in the opposite direction (aiming for a 20–25 point retracement from that level). Selling the pound today is suitable only if the central bank adopts a very dovish stance.

Important: Before selling, make sure the MACD indicator is below the zero line and just starting to decline.

Scenario #2: I also plan to sell the pound today in case of two consecutive tests of the 1.3378 level while the MACD indicator is in the overbought zone. This would limit the pair's upside potential and lead to a downward market reversal. A drop toward the opposite levels of 1.3355 and 1.3315 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.