As we predicted, the EUR/USD currency pair collapsed on Monday. However, the collapse was not of the pair but rather of the U.S. dollar. Recall that over the weekend, it was announced that Donald Trump intends to raise tariffs on steel and aluminum imports "to further protect American metal producers." How else could traders react on Monday except with another wave of selling off the U.S. dollar?

Unfortunately, those who hoped that the events of April–May marked the beginning of a reduction in trade tensions were mistaken. Trump initially granted everyone "preferential tariffs" for 90 days to allow countries time for productive trade negotiations. But it's been two months since Trump's magnanimity knew no bounds, and no single trade deal has been signed—except with the United Kingdom. How long the negotiations will continue is unknown. The stage of the negotiations is also unclear. Thus, the dollar's dominance was very short-lived.

Last week, a series of news reports prompted traders to yet again flee from the U.S. dollar. As mentioned, Trump announced that starting June 4, tariffs on steel and aluminum imports—which apply to all countries—would be raised to 50%. Several countries (like Canada) have already announced that they will also retaliate by raising tariffs. Not long ago, we also witnessed the "American Circus," where one court canceled all of Trump's tariffs, only to have another court overturn that decision the next day.

In addition, China and the U.S. have engaged in a new war of words, accusing each other of violating the Geneva Agreements. As a result, the dollar is plunging once again. Not as rapidly as it did in February–March, but it's falling nonetheless. Let's recall that apart from the trade chaos, there are still no substantial reasons for the dollar's decline. The Federal Reserve maintains its interest rate as high as possible under the current circumstances, while the European Central Bank is expected to cut its rate for the eighth time this week. The U.S. economy, although slowing, remains relatively stable and strong. In any case, the economic slowdown directly results from the tariffs. The slowdown would unlikely have occurred if the country were still led by "the clueless and old Joe Biden."

Of course, all of this is America's problem. Americans elected Trump themselves and now will pay more for a good portion of the goods on store shelves. But at least Trump plans to lower some taxes—and simultaneously cut funding for several social programs for low-income groups. Money doesn't just appear out of thin air—unless you're the Fed. If Trump pledges to cut taxes while facing a perpetual budget deficit, it implies that someone else must contribute more funds to the budget. As has become evident to everyone, that "someone" will not be sanctioned countries; it will be ordinary Americans.

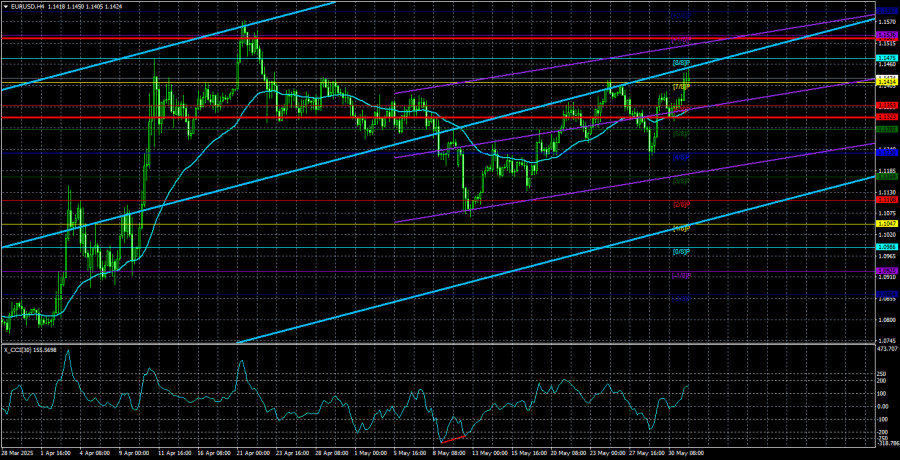

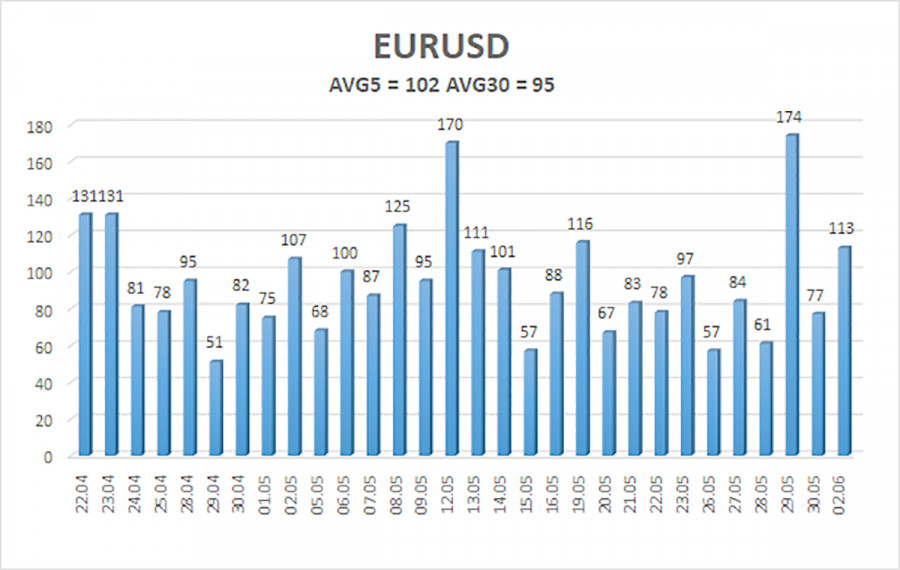

The average volatility of the EUR/USD currency pair over the past five trading days as of June 3 is 102 pips, classified as "moderate." We expect the pair to move between the levels 1.1323 and 1.1527 on Tuesday. The long-term regression channel is directed upwards, still indicating an upward trend. The CCI indicator dipped into oversold territory, and a "bullish" divergence formed, signaling a trend resumption.

Nearest Support Levels:

S1 – 1.1414

S2 – 1.1353

S3 – 1.1292

Nearest Resistance Levels:

R1 – 1.1475

R2 – 1.1536

R3 – 1.1597

Trading Recommendations:

The EUR/USD pair is trying to resume its upward trend. For the past few months, we have consistently stated that we expect only declines from the euro in the medium term because the dollar still has no fundamental reasons to fall—apart from Trump's policies, which will likely have destructive and long-term consequences for the U.S. economy. Nevertheless, we continue to observe the market's complete unwillingness to buy dollars, even when there are reasons to do so, and the complete disregard of positive factors for the dollar.

If the price is below the moving average, short positions with targets at 1.1292 and 1.1230 are relevant, but significant dollar growth should not be expected. Long positions can be considered above the moving average line, with targets at 1.1475 and 1.1527.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.