Wall Street's roller coaster: May ends with strong rally

A turbulent month came to a strong finish, as the benchmark S&P 500 closed Friday almost exactly where it started the day. Despite a choppy session, May delivered the index's biggest monthly gain since November 2023. The Nasdaq showed a similarly impressive performance, posting its highest percentage increase for the same period.

Political whiplash and market nerves Throughout the month, investors felt like they were living out of suitcases. President Donald Trump's shifting rhetoric on trade relations with China kept markets on edge. His sharp criticism alternated with signals of renewed dialogue, making it nearly impossible to predict index movements.

Yet despite the turbulence, the markets recovered from the April dip. Support came from solid corporate earnings and moderate inflation data, which helped restore a cautious sense of optimism.

Morning tension, evening hope Friday began on a sour note. Trump posted a harsh rebuke of China on his social media platform Truth Social, accusing Beijing of breaching trade agreements. He also hinted that the US might adopt a tougher stance in the trade conflict.

However, by day's end, his tone had softened. Trump announced his intention to speak with Chinese President Xi Jinping and expressed hope for a resolution on key issues, including tariffs. This shift in messaging helped ease earlier losses and steadied the markets by the close.

Investors balancing between data and interest rates

Despite mixed index dynamics on Friday, overall market sentiment remained cautiously optimistic. The S&P 500 ended the week on a positive note, continuing to recover recent losses and moving within 4% of its all-time high set in February.

Inflation data boosts confidence New macroeconomic data also gave markets more to digest. In April, U.S. consumer spending rose by 2.1% year-over-year, slightly down from 2.3% in March. These numbers are consistent with a broader trend of easing inflation, which the Federal Reserve is closely monitoring.

Tariffs stay in spotlight According to Oxford Research, the average US import tariff, which stood at around 2–3% before President Trump's administration, has increased to 15%. Although a trade court has ruled to reduce it to 6%, an appellate court has temporarily upheld the higher rate.

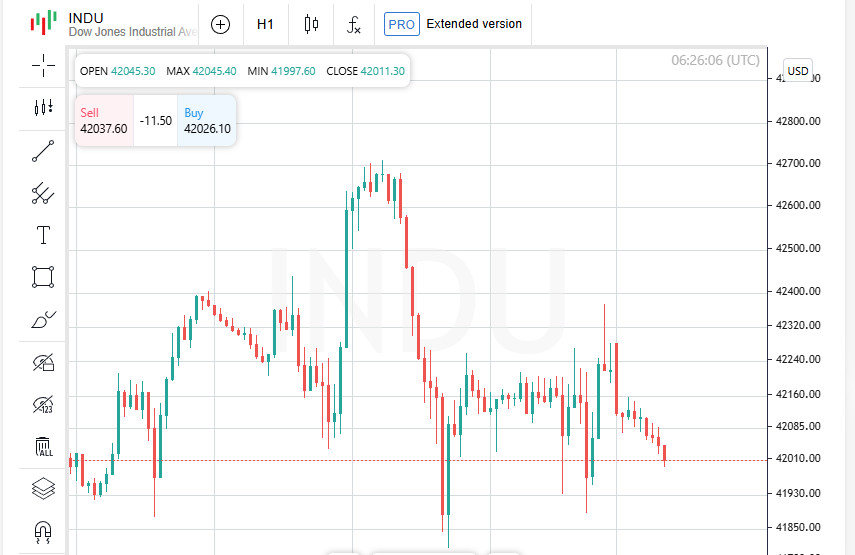

Indices snapshot

- The Dow Jones Industrial Average rose by 54.34 points (+0.13%) to 42,270.07

- The S&P 500 slipped slightly by 0.48 points (–0.01%) to 5,911.69

- The Nasdaq Composite fell by 62.11 points (–0.32%) to 19,113.77

Ulta stuns Wall Street Shares of beauty retailer Ulta Beauty surged nearly 12% after the company not only exceeded quarterly expectations but also raised its full-year revenue forecast. This strong report reinforced Ulta's standing as a sector leader amid intense competition and cautious consumer spending.

Indian Markets Under Pressure

On Monday, Indian stock indices slipped into negative territory despite upbeat economic data. The main culprit was unease from global markets. The fall in shares of metal and IT companies, triggered by renewed concerns over the potential escalation of U.S. tariff policies, weighed on the broader market.

Indian index summary

- The Nifty 50 dropped by 0.65% to 24,588.50

- The BSE Sensex declined by 0.72% to 80,865.54 (as of 10:08 a.m. IST)

Tariff threat resurfaces

Fresh anxiety came from a comment by Donald Trump, who stated that steel and aluminum import tariffs might be raised to 50% starting June 4. This statement heightened concerns across markets, especially in Asia, where such rhetoric is viewed as a direct risk to export-driven industries.

Sectors in the red

- The Nifty Metal index fell by 0.7%

- The Nifty IT index, closely tied to the US market, dropped 1%

- HDFC Bank and Reliance Industries both declined by 1.5%

- ICICI Bank shed 0.8%

GDP growth fails to reverse market

Even the strong GDP data for March, driven largely by construction and manufacturing activity, failed to reverse the downward market trend. Selling pressure dominated, and only a few sectors managed to escape the slide.

Domestic growth cannot offset global uncertainty

Despite the solid performance of the Indian economy, trade-related uncertainty from the US continues to weigh heavily on investor sentiment. V. K. Vijayakumar, Chief Investment Strategist at Geojit Financial Services, noted that the anticipated hike in steel and aluminum tariffs might further shake market confidence, even against a backdrop of domestic economic resilience.

Corporate setbacks add to decline

Mphasis plunged 3.1% following reports that it had lost a long-time client, FedEx, which accounted for 8% of the company's revenue.

Niva Bupa Health Insurance tumbled 11%, marking its steepest drop since the IPO. The decline was driven by a major block deal at an 11% discount, worth $126 million, according to IFR data.

Healthcare sector moves higher

Apollo Hospitals rose 2.5% after reporting strong quarterly results, supported by sustained demand for medical services.

AstraZeneca Pharma India rallied 8.7% following a sharp increase in March profits, a result that investors welcomed with optimism.

Small- and mid-cap indices gain ground

Despite muted movement in benchmark indices, broader indices geared toward domestic demand showed greater resilience:

- The mid-cap index gained about 0.4%

- The small-cap index also climbed roughly 0.4%, recovering from morning losses

Schloss Bangalore stumbles on IPO debut

Schloss Bangalore, operator of The Leela luxury hotel chain, failed to impress with its market debut. The stock fell 6.7% on IPO day, a surprising signal of tepid investor interest.