Analysis of Wednesday's Trades

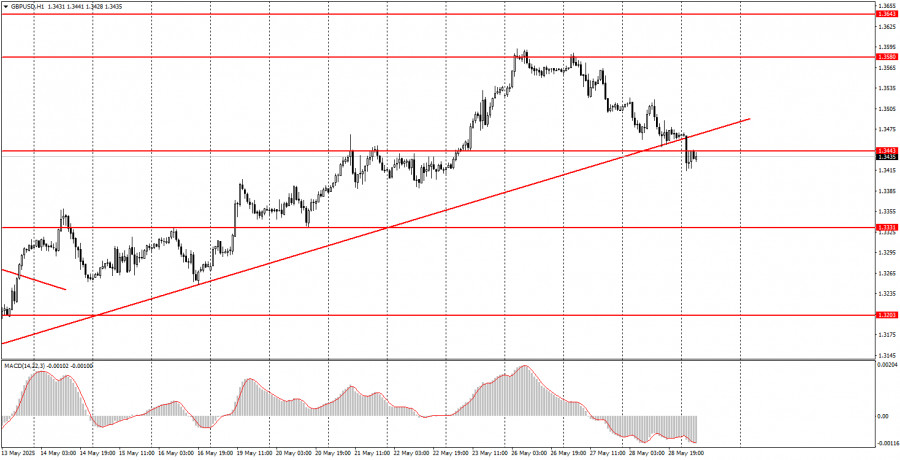

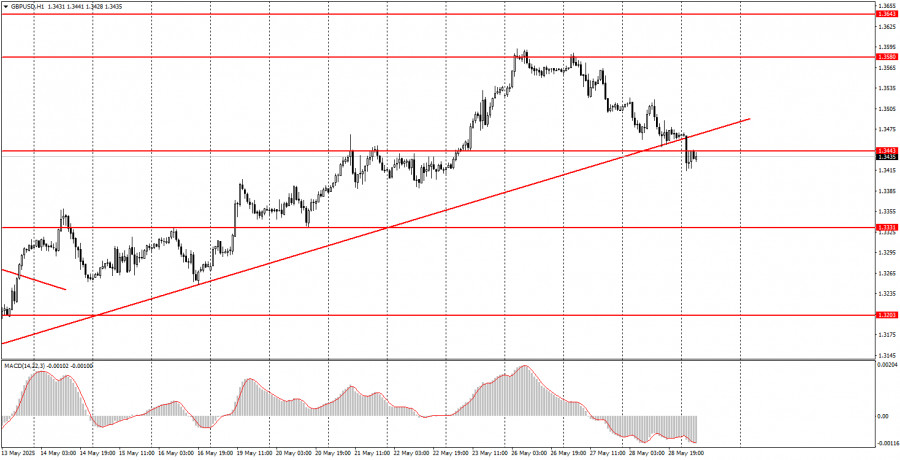

1H Chart of GBP/USD

On Wednesday, the GBP/USD pair continued its movement toward the ascending trend line, and during the night into Thursday, it unexpectedly broke below it. As we mentioned in the article on the euro, there were no strong reasons for the sharp rise in the U.S. dollar. The dollar has been gaining value for three consecutive days, which seems odd. Of course, technical corrections are always possible, but traders have grown unaccustomed to such a development as dollar appreciation over the past three to four months. The Federal Reserve minutes published Wednesday evening offered no fundamentally new information. Thus, the downward movement may continue, but it's important to remember that the fundamental background has not changed this week, and the market's selective focus remains intact. Recall that the market has repeatedly ignored positive factors for the dollar in recent months. It's impossible to predict when the market will begin to consider the entire fundamental picture again rather than only news related to the global trade war.

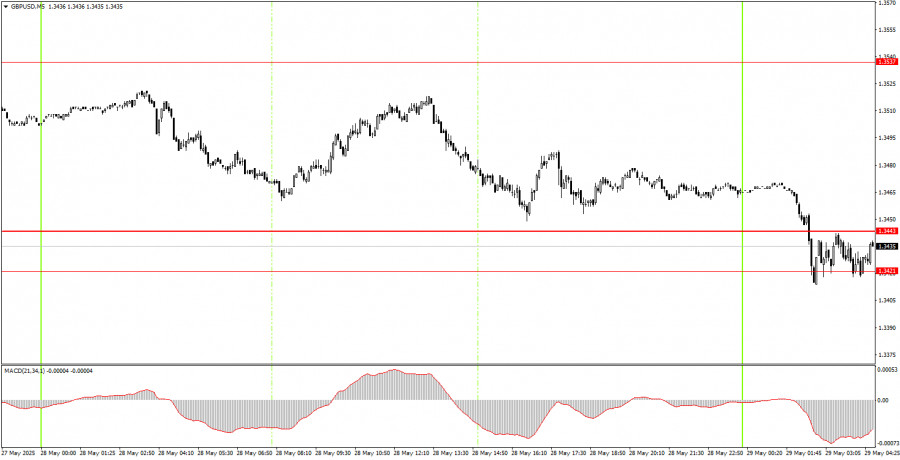

5M Chart of GBP/USD

No trading signals were generated in the 5-minute timeframe on Wednesday. The price approached the 1.3443 level once, and it's good that a buy signal wasn't formed—the pair was in decline most of the day. Later, during the night, the price consolidated in the 1.3421–1.3443 area. Once again, the British pound showed a much milder decline than the euro, and the dollar has no grounds to continue rising—apart from technical ones.

Trading Strategy for Thursday:

In the hourly timeframe, the GBP/USD pair continues to react primarily to Donald Trump and remains highly skeptical of his policies. Some signs of easing trade tensions are present, but the market is not feeling a surge of optimism in this regard. The dollar has been strengthening over the past few days, but this appears to be just a technical correction. Even after breaking the trend line, we wouldn't risk calling this the start of a dollar trend.

The GBP/USD pair may continue moving south on Thursday now that the trend line has been broken. However, there are no fundamental drivers for such a move. We remain skeptical about the dollar's growth, but it's better to trade based on technical signals in the current environment.

On the 5-minute timeframe, current levels to watch for trading include: 1.2913, 1.2980–1.2993, 1.3043, 1.3102–1.3107, 1.3203–1.3211, 1.3259, 1.3329–1.3331, 1.3421–1.3443, 1.3537, 1.3580–1.3592, 1.3652–1.3660, 1.3695. No significant events are scheduled in the UK for Thursday, and in the U.S., only the second estimate of Q1 GDP will be released. It's worth noting that the market ignored the first estimate, and the second is considered the least important.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 20 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.