Analysis of Wednesday's Trades

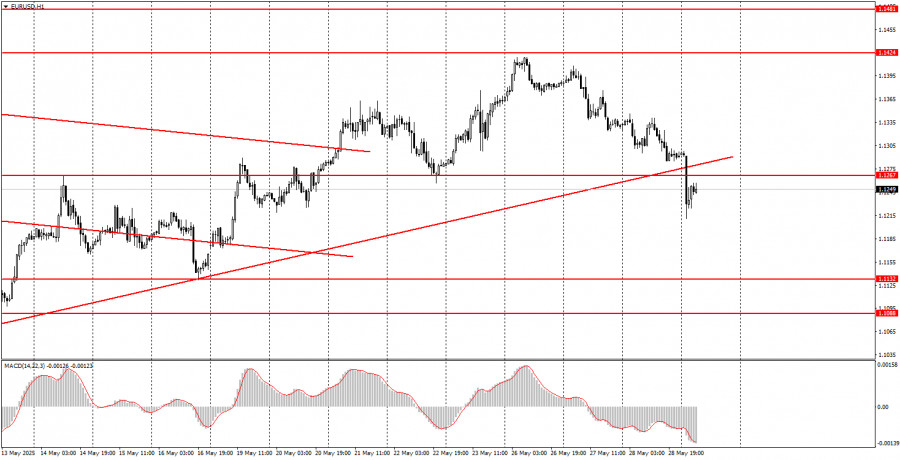

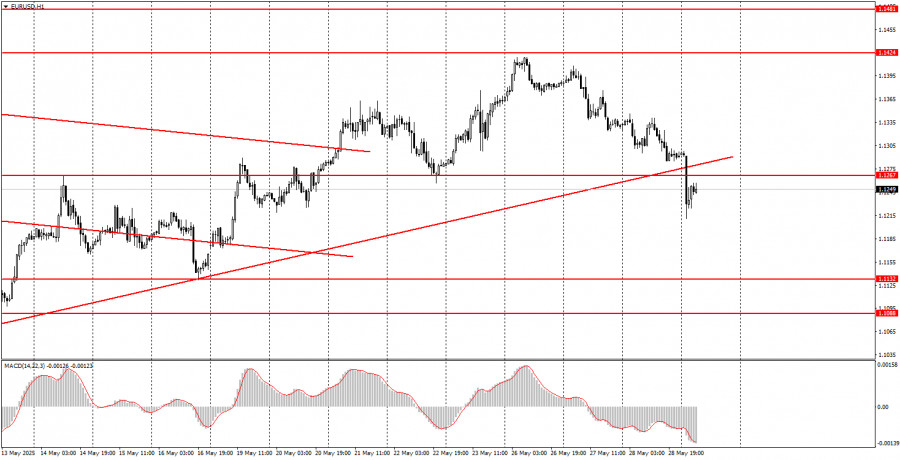

1H Chart of EUR/USD

On Wednesday, the EUR/USD currency pair continued its downward movement, and during the night into Thursday, it experienced a sharp drop. There were no strong reasons yesterday or especially overnight for a renewed surge in the dollar. The U.S. currency has been appreciating for three consecutive days—something it hasn't done in a while. Most importantly, nothing has changed in the news landscape to justify such a sharp appreciation of the dollar. There were no news releases from the U.S. or the EU on Wednesday, and the market confidently ignored the Federal Reserve's minutes. However, we previously warned that not only fundamental and macroeconomic factors matter—technical ones do as well. The dollar has broken all records in its three-month decline, so a correction was brewing. It's impossible to predict the exact moment when market participants will start taking profits on earlier positions. All we can do is attempt to identify trend reversals on lower timeframes using technical tools.

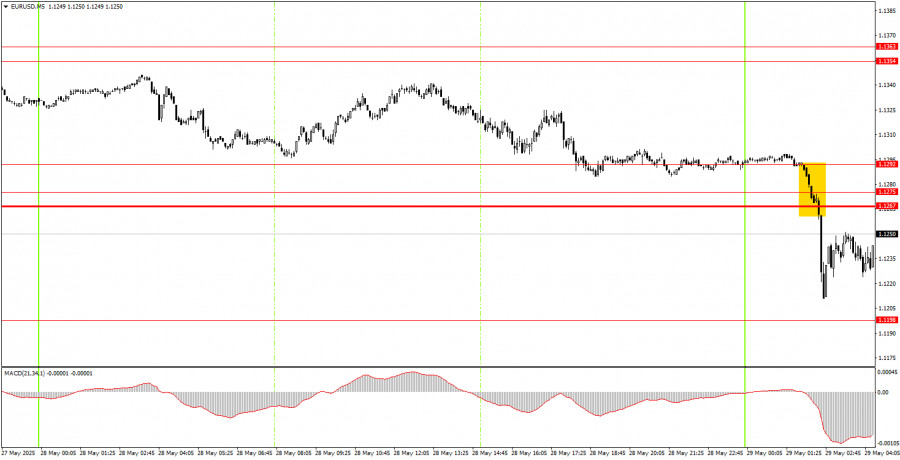

5M Chart of EUR/USD

No trading signal was formed on Wednesday in the 5-minute timeframe. At the beginning of the European session, the price came close to the 1.1292 level but failed to test it. Overnight on Thursday, there was a sharp breakout below the 1.1267–1.1292 zone, but reacting to it was extremely difficult. If novice traders entered a trade based on this signal, they could remain in the position today, setting a Stop Loss to breakeven.

Trading Strategy for Thursday:

The EUR/USD pair has broken below the ascending trend line in the hourly timeframe. However, the upward trend that began when Trump became president could continue. In fact, for the U.S. dollar to consistently depreciate, the fact that Trump is president is sufficient on its own. This is already a strong enough reason for the market to flee from the dollar. If Trump resumes issuing threats and ultimatums and introduces or raises tariffs, the market will have few options. Currently, we are witnessing a technical correction.

On Thursday, the EUR/USD pair may continue its downward correction, especially since the trend line has been broken. At the same time, it's important to remember that the dollar has no strong reasons to grow.

On the 5-minute timeframe, the relevant levels to monitor are 1.0940–1.0952, 1.1011, 1.1088, 1.1132–1.1140, 1.1198, 1.1267–1.1292, 1.1354–1.1363, 1.1413–1.1424, 1.1474–1.1481, 1.1513, 1.1548, 1.1571, 1.1607–1.1622. No significant events are scheduled in the Eurozone for Thursday, while in the U.S., the second estimate of Q1 GDP will be published. This is not a particularly important indicator and is unlikely to provide any positive surprise for the dollar.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.