Analysis of Tuesday's Trades

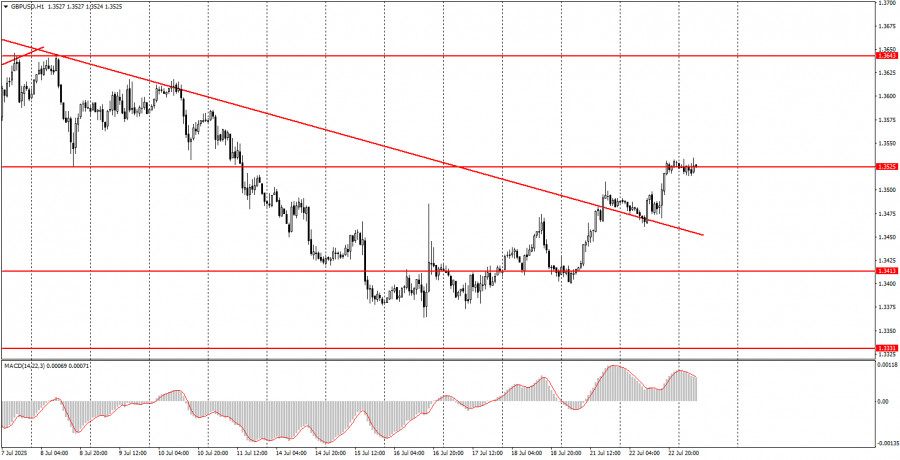

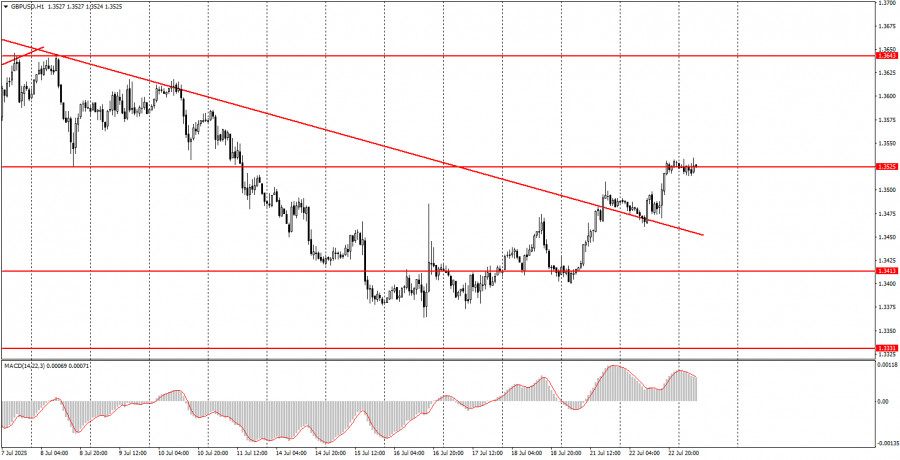

1H Chart of GBP/USD

The GBP/USD pair also continued its upward movement on Tuesday. As expected, this did not require any news or reports. One could assume that Jerome Powell's speech triggered another drop in the U.S. dollar, but as of Wednesday morning, there is no information confirming this. Powell, contrary to the expectations of some experts, did not resign and appears ready to defend his honor and reputation in the confrontation over accusations made by Donald Trump and his fellow party members regarding overspending on the reconstruction of Federal Reserve buildings. Thus, the Fed's key interest rate remains unchanged for now and is likely to stay that way in the near future. While the rate itself may not be critical for the U.S. dollar, Powell's potential resignation certainly is. If the Fed Chair is removed from office, the U.S. dollar is likely to decline much faster than it is currently. And it will continue to fall, regardless, since the downward technical correction has been completed.

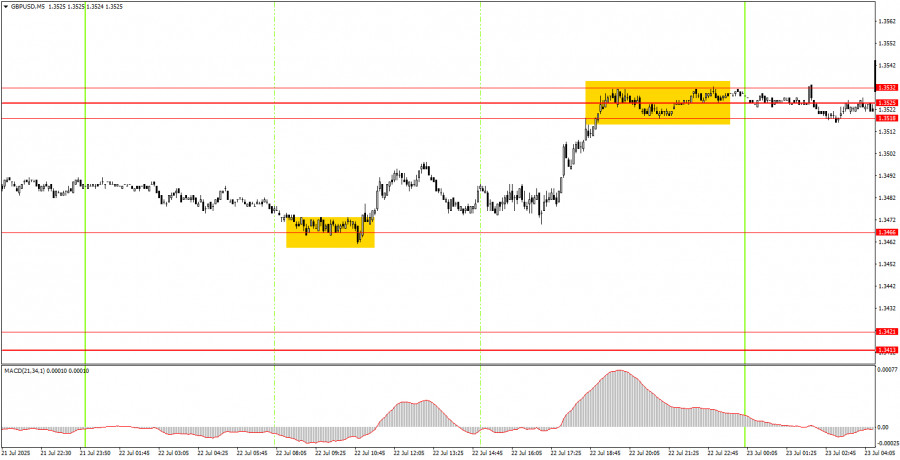

5M Chart of GBP/USD

In the 5-minute timeframe on Tuesday, one trading signal was formed, and unlike the signal for the euro, it was almost perfect. During the European session, the price rebounded from the 1.3466 level and, by evening, had reached its nearest target—the 1.3518–1.3532 area. Therefore, novice traders had an excellent opportunity to open long positions, which resulted in a profit of no less than 45 pips.

Trading Strategy for Wednesday:

On the hourly timeframe, the GBP/USD pair is showing readiness to form a new local upward trend. The price has consolidated above the descending trendline, so further growth can be expected in the coming weeks. The fundamental background continues to weigh against the U.S. dollar, and the market has yet to price in many factors unfavorable to the American currency.

On Wednesday, the GBP/USD pair may continue to rise, despite the absence of any scheduled macroeconomic or fundamental events for today. We believe that a break above the 1.3518–1.3532 area would open the way for the British pound to reach the 1.3574 level.

On the 5-minute timeframe, the following levels can be used for trading: 1.3203–1.3211, 1.3259, 1.3329–1.3331, 1.3413–1.3421, 1.3466, 1.3518–1.3525, 1.3574–1.3590, 1.3643–1.3652, 1.3682, 1.3763, 1.3814–1.3832. There are no notable events on the economic calendars for the U.S. or the UK on Wednesday. It's unlikely that the new home sales report will attract serious attention. As a result, the market may exhibit low volatility and range-bound movement throughout the day, although the dollar may continue to decline due to broader fundamental factors.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 20 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.