The GBP/USD currency pair once again leaned toward decline on Thursday. After the British pound strengthened on Wednesday evening following another report about Powell's dismissal, the dollar quickly recovered. However, it failed to continue strengthening on Thursday. As seen above, the pair retraced precisely to its previous local low around the Murray level "3/8" at 1.3367. In our view, there were no real reasons even for such a substantial decline. The market adjusted to a technical correction and followed this scenario for several weeks, using any formal pretext as justification. But with each new day of dollar strengthening, the question became more pressing: on what basis will the U.S. currency continue its confident ascent?

Let us recall that this week, the market reacted to a rather bland and predictable U.S. inflation report but ignored the high-impact inflation data from the UK. British data were largely overlooked—on Thursday, inflation and jobless claims both rose, yet the market didn't respond by buying dollars. Over the past two weeks, the market has also largely ignored Donald Trump's new tariffs, including the tariff hikes for 24 countries that are set to take effect on August 1. Nevertheless, the dollar had been strengthening for three consecutive weeks, and now the question of a correction to the upside is pressing.

In our opinion, the latest dollar rally was designed to convince as many traders as possible that the worst is over for the dollar. During its six-month decline, the U.S. currency has exhibited similar sharp corrections on several occasions, each followed by renewed weakening. The current situation in the forex market is ambiguous, as the dollar could continue rising technically. At the same time, however, the market seems to be ignoring the fundamental backdrop. We understand that it feels unusual to sell the dollar for 7–10 consecutive months, especially after it had been rising for 16 years. But Trump and his administration do not even hide the fact that they want a "cheap" dollar, not a "strong" one.

We believe the market may soon simply grow tired of buying the U.S. dollar. It's challenging to say that the dollar's rally has been particularly strong, as evidenced by the daily timeframe. Thus, based on technical factors, traders can consider short positions; however, they should remember that fundamentals continue to support all currencies, except the U.S. dollar. Therefore, we would expect the resumption of the "2025 trend." Even the Federal Reserve's hawkish policy no longer seems to support the dollar, as it has remained unchanged since last year. Formally, this policy should have supported the dollar throughout 2025, especially while the European Central Bank and the Bank of England pursued monetary easing. The market environment is mixed.

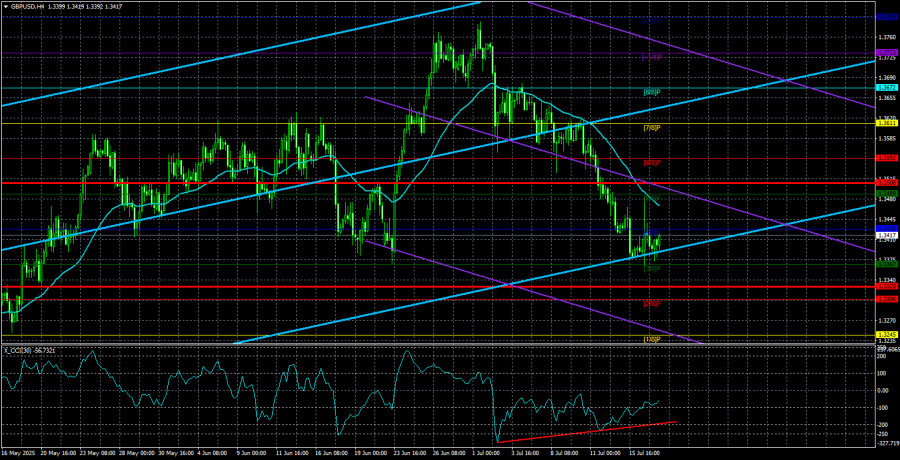

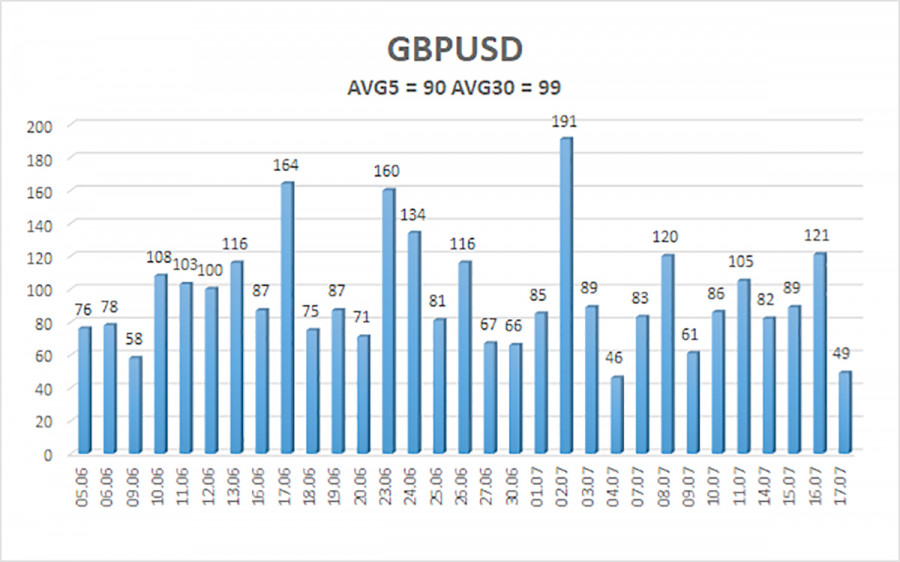

The average volatility of the GBP/USD pair over the last five trading days is 90 pips. For the pound/dollar pair, this is considered "moderate." On Friday, July 18, we therefore expect movement within the range of 1.3328 to 1.3508. The long-term linear regression channel is directed upward, indicating a clear upward trend. The CCI indicator has entered oversold territory twice, signaling a possible resumption of the uptrend. "Bullish" divergences are also forming.

Nearest Support Levels:

S1 – 1.3367

S2 – 1.3306

S3 – 1.3245

Nearest Resistance Levels:

R1 – 1.3428

R2 – 1.3489

R3 – 1.3550

Trading Recommendations:

The GBP/USD currency pair continues a downward correction, which may soon come to an end. The pair has retraced sufficiently, and over the medium term, Trump's policies are likely to continue putting pressure on the dollar. Thus, long positions with targets at 1.3611 and 1.3672 remain relevant if the price consolidates above the moving average. If the price remains below the moving average, small short positions with targets at 1.3367 and 1.3328 can be considered on purely technical grounds. Occasionally, the U.S. currency shows corrective growth, but for a sustained trend, it needs genuine signs that the global trade war is coming to an end.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.